|

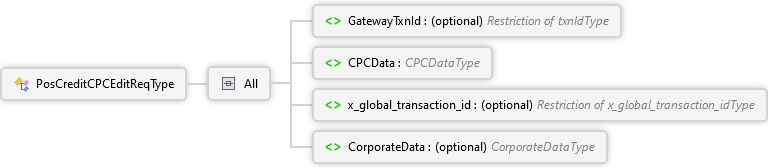

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the transaction to be updated.

|

|

|

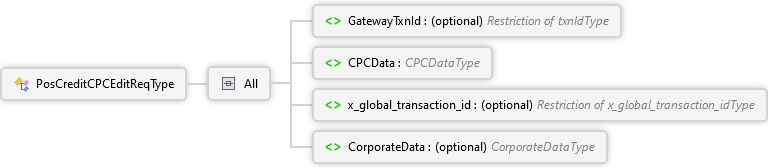

All

|

TaxType optional taxTypeType Simple Type

Tax type indicator that qualifies the associated tax amount, see the associated Type enumerations for specific values supported.

|

|

TaxAmt optional amtTypeGlobal Simple Type

Tax amount

Note: If the tax type is 'TaxExempt', an amount should not be provided. If it is, the gateway discards the amount.

|

|

|

All

|

BuyerRecipientName optional Restriction of xs:string

Required on transactions with an amount over 150.

|

| | | |

|

|

|

|

Sequence

|

Choice

|

|

All

|

SummaryCommodityCode optional Restriction of xs:string

Contains the 4-character national standard coding structure for the description of goods.May contain be null or all spaces.

|

|

DiscountAmt optional Restriction of xs:decimal

Contains the total discount amount applied to the transaction. This field may be null or contain zeroes if no discount was given.

If amount value is positive, then value is treated as discount for the invoice.

If amount value is negative, then value is treated as refund discount for the invoice.

|

|

FreightAmt optional Restriction of xs:decimal

Contains the total Freight/Shipping Amount. This field may be null or contain zeroes if no freight/shipping amount was applied.

If amount value is positive, then value is treated as positive for the invoice.

If amount value is negative, then value is treated as negative for the invoice.

|

|

DutyAmt optional Restriction of xs:decimal

Contains the Duty Amount. This field may be null or contain zeroes if no freight/shipping amount was applied.

If amount value is positive, then value is treated as positive for the invoice.

If amount value is negative, then value is treated as negative for the invoice.

NOTE: Duty may also be called Import Tax, Excise, or Customs Tax.

|

|

ShipFromPostalZipCode optional Restriction of xs:string

Postal code of the location being shipped from. May contain spaces.

|

|

DestinationCountryCode optional Restriction of xs:string

The 3-digit ISO Numeric Country Code of destination location (eg, 840). May contain spaces

|

|

InvoiceRefNbr optional Restriction of xs:string

Value Added Tax invoice reference number. May contain spaces.

|

|

OrderDate optional xs:dateTime

Date the order was taken. May be null or contain zeros.

|

|

VATTaxAmtFreight optional Restriction of xs:decimal

Contains any Value Added Tax Amount or Other Sales Tax Amount. This field may be null or contain zeroes if no freight/shipping tax amount was applied.

If amount value is positive, then value is treated as positive for the invoice.

If amount value is negative, then value is treated as negative for the invoice.

|

|

VATTaxRateFreight optional Restriction of xs:decimal

The Tax Rate of the Value Added Tax or Other Sales Tax.

|

|

DiscountTreatment optional Restriction of xs:int

Indicates how the merchant is managing discount.

Valid values:

0 - no invoice level discount provided

1 - tax was calculated on the post-discount invoice total.

2 - tax was calculated on the pre-discount invoice total.

|

|

TaxTreatment optional Restriction of xs:int

Indicates how the merchant is handling taxes

Valid values:

0 - NLL (net prices with tax calculated a line item level)

1 - NIL (net prices with tax calculated at invoice level)

2 - GLL (gross prices given with tax information provided at the line item level)

3 - GIL (gross prices given with tax information provided at invoice level)

4 - NON (no tax applies on the invoice for the transaction)

|

| |

|

|

All

|

DiscountAmt optional Restriction of xs:decimal

Contains the total discount amount applied to the transaction. This field may be null or contain zeroes if no discount was given.

If amount value is positive, then value is treated as discount for the invoice.

If amount value is negative, then value is treated as refund discount for the invoice.

|

|

FreightAmt optional Restriction of xs:decimal

Contains the total Freight/Shipping Amount. This field may be null or contain zeroes if no freight/shipping amount was applied.

If amount value is positive, then value is treated as positive for the invoice.

If amount value is negative, then value is treated as negative for the invoice.

|

|

DutyAmt optional Restriction of xs:decimal

Contains the Duty Amount. This field may be null or contain zeroes if no freight/shipping amount was applied.

If amount value is positive, then value is treated as positive for the invoice.

If amount value is negative, then value is treated as negative for the invoice.

|

|

ShipFromPostalZipCode optional Restriction of xs:string

Postal code of the location being shipped from. May contain spaces.

|

|

DestinationCountryCode optional Restriction of xs:string

The 3-digit ISO Numeric Country Code of destination location (eg, 840). May contain spaces

|

|

InvoiceRefNbr optional Restriction of xs:string

Card Acceptor Reference Number.

Visa: Value Added Tax invoice reference number. May contain spaces.

For Mastercard: Card Acceptor Reference Number.

|

|

OrderDate optional xs:dateTime

Indicates date the purchase was made in YYMMDD format.

|

| | | | | |