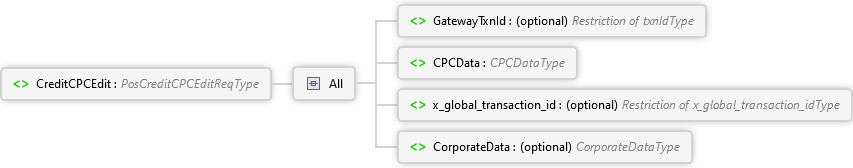

CreditCPCEdit attaches Corporate Purchase Card (CPC) data to a prior transaction. This information will be passed to the issuer at settlement when the associated card was a corporate card or an AMEX card.

Note: This function only works against previously approved CreditAuth, CreditSale, CreditOfflineAuth, CreditOfflineSale, RecurringBilling, and RecurringBillingAuth transactions.

Note: The amount of the original transaction is not altered by the CreditCPCEdit. This additional data is informational only. The original transaction will be processed regardless of whether or not the CreditCPCEdit is used by the client.