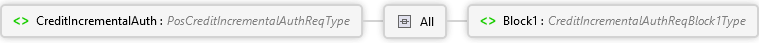

CreditIncrementalAuth adds to the authorized amount for a prior transaction.

The following rules apply:

- The original transaction must be an approved CreditAuth.

- Note: CreditSale is allowed for US merchants processing to the Exchange host only.The original transaction id should continue to be used for subsequent transactions (i.e., voids, reversals, edits, etc.); the transaction id of the incremental authorization should never be referred to by subsequent transactions.

- Each incremental authorization is not added to the batch. The total amount is maintained with the original transaction.

- If the final settlement amount of the original transaction is less than the total of all authorizations, reversals will automatically be generated as needed.

Note:UnionPay cards routed directly to UnionPay International do not support Incremental Authorizations. CreditIncrementalAuth may be used for UnionPay the Discover or JCB networks. (available merchants on the GSAP authorization platform only).