|

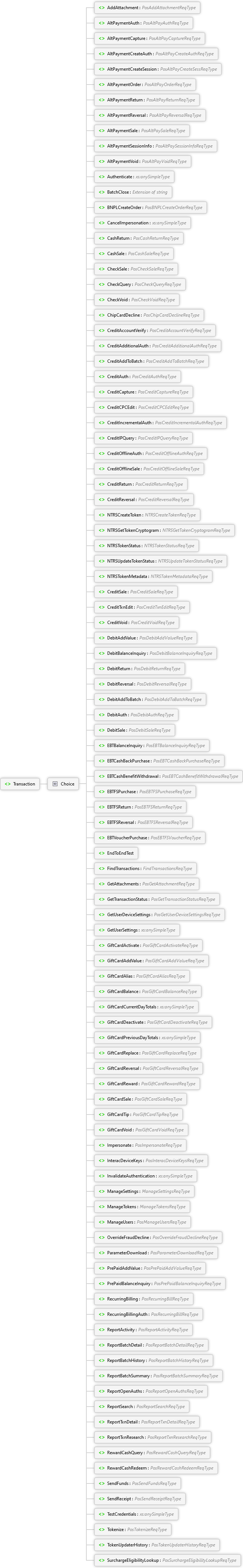

Choice

|

AddAttachment PosAddAttachmentReqType Complex Type

AddAttachment can be used to store and associate data (i.e. images and documents) to a prior transaction.

The referenced original transaction must have been approved and must be one of the following:

- CreditAuth

- CreditOfflineAuth

- CreditSale

- CreditOfflineSale

- CreditReturn

- DebitSale

- GiftCardSale

- GiftCardAddValue

- PrePaidAddValue

- CheckSale

- OverrideFraudDecline

This must be done within three months of the original transaction.

For Document attachment types:

- Up to five document attachments are allowed to be associated with a single transaction

- Document attachments can be submitted on one or more requests

- To replace a document attachment, a new document attachment with the same name can be provided

For other attachment types:

- Only one of each attachment type can be associated with a single transaction

- Only one of each attachment type can be submitted per request

- If a request includes an attachment type that is already associated with a given transaction, it will result in the attachment being replaced

|

Sequence

|

GatewayTxnId txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the transaction to be updated.

|

|

|

All

|

AttachmentData Restriction of xs:string

The base64 encoded attachment data.

Note: The code limits the maximum size beyond the limit in the schema. The maximum document and image data size allowed is 300K which includes the encoding overhead.

|

|

AttachmentName optional Restriction of xs:string

A merchant assigned name for the associated attachment.

| | | | |

|

|

All

|

Buyer optional

Buyer Information for the authorization

|

Sequence 1..50

| |

|

Shipping optional

Shipping Information for the authorization

|

Sequence 1..10

| |

|

Payment optional

Payment Information for the authorization

|

Sequence 1..200

| |

|

LineItem optional

Line Item purchase information for the authorization

|

Sequence 1..100

| | | |

|

AltPaymentCapture PosAltPayCaptureReqType Complex Type

AltPaymentCapture takes a previously approved Alternate Payment Authorization or Alternate Payment Order and captures a portion of the original into the current open batch. If a batch is not open, this transaction will create one.

|

All

|

GatewayTxnId txnIdType Simple Type

Gateway generated transaction identifier returned in the response of the original transaction. This indicates the AltPayment transaction to be captured against.

|

|

Payment optional

Payment Information for the capture

|

Sequence 1..200

| | | |

|

|

All

|

GatewayTxnId txnIdType Simple Type

Gateway generated transaction identifier returned in the response of the original transaction. This indicates the original Alt Payment transaction to create an authorization against.

|

|

Shipping optional

Shipping Information for the new authorization

|

Sequence 1..10

| |

|

Payment optional

Payment Information for the new authorization

|

Sequence 1..200

| |

|

LineItem optional

Line Item purchase information for the new authorization

|

Sequence 1..100

| | | |

|

|

All

|

Buyer optional

Buyer Information for the session

|

Sequence 1..50

| |

|

Shipping optional

Shipping Information for the session

|

Sequence 1..10

| |

|

Payment optional

Payment Information for the session

|

Sequence 1..200

| |

|

LineItem optional

Line Item purchase information for the session

|

Sequence 1..100

| | | |

|

|

All

|

Buyer optional

Buyer Information for the order

|

Sequence 1..50

| |

|

Shipping optional

Shipping Information for the order

|

Sequence 1..10

| |

|

Payment optional

Payment Information for the order

|

Sequence 1..200

| |

|

LineItem optional

Line Item purchase information for the order

|

Sequence 1..100

| | | |

|

|

All

|

GatewayTxnId txnIdType Simple Type

Gateway generated transaction identifier returned in the response of the original transaction. This indicates the Alt Payment transaction to be returned.

|

|

Return optional

Return information for the return

|

Sequence 1..50

| | | |

|

AltPaymentReversal PosAltPayReversalReqType Complex Type

AltPaymentReversal takes a Alternate Payment GatewayTxnId and performs a reversal against that transaction. Abanonded timed out transactions of AltPaymentSale, AltPaymentOrder, AltPaymentAuth and AltPaymentCapture can be reversed

|

All

|

GatewayTxnId txnIdType Simple Type

Gateway generated transaction identifier returned in the response of the original transaction. This indicates the Alt Payment transaction to be reversed.

| | |

|

|

All

|

Buyer optional

Buyer Information for the sale

|

Sequence 1..50

| |

|

Shipping optional

Shipping Information for the sale

|

Sequence 1..10

| |

|

Payment optional

Payment Information for the sale

|

Sequence 1..200

| |

|

LineItem optional

Line Item purchase information for the sale

|

Sequence 1..100

| | | |

|

|

All

| |

|

|

All

|

GatewayTxnId txnIdType Simple Type

Gateway generated transaction identifier returned in the response of the original transaction. This indicates the Alt Payment transaction to be voided.

| | |

|

Authenticate xs:anySimpleType

Authenticate is used to authenticate a specific user. For this call the header must include username and password.

Note: This is for internal use only.

|

|

BatchClose Extension of xs:string

BatchClose is used to settle and close the current open batch. If a batch is not open an error will be returned.

|

deviceId optional xs:int

| |

|

|

Sequence

|

|

All

|

BnplProvider Restriction of xs:string

Bnpl Provider choosen by customer

|

| | | |

|

|

Sequence

|

|

All

|

BnplId xs:string

Id received from the BNPL Provider

|

|

Type Restriction of xs:string

Type of secondary Txn, possible values: CAPTURE, REFUND, REVERSAL

| | | | |

|

CancelImpersonation xs:anySimpleType

CancelImpersonation is used to terminate a previously started impersonation session.

Note: This is for internal use only.

|

|

CashReturn PosCashReturnReqType Complex Type

CashReturn creates a log of a transaction that is returning cash to a customer. This is processed offline.

Note: The client is responsible for maintaining any required cash value totals for reconciliation.

|

Sequence

|

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This must refer to a prior CashSale.

|

| | | |

|

CashSale PosCashSaleReqType Complex Type

CashSale creates a log of a transaction, in which cash is collected from a customer. This is processed offline.

Note: The client is responsible for maintaining any required cash value totals for reconciliation.

|

Sequence

|

|

All

|

Amt amtTypeGlobal Simple Type

The cash amount paid by the customer; this is the sale total and includes all other "Info" amounts provided as part of this request.

|

|

GratuityAmtInfo optional amtTypeGlobal Simple Type

Gratuity amount information; this defines the portion of the total amount provided as part of this request that was specifically for gratuity. This is informational only and will not alter the amount processed as part of the transaction.

|

|

ShippingAmtInfo optional amtTypeGlobal Simple Type

Shipping amount information; this defines the portion of the total amount provided as part of this request that was specifically for shipping. This is informational only and will not alter the amount processed as part of the transaction.

|

|

TaxAmtInfo optional amtTypeGlobal Simple Type

Tax amount information; this defines the portion of the total amount provided as part of this request that was specifically for tax. This is informational only and will not alter the amount processed as part of the transaction.

|

| | | |

|

CheckSale PosCheckSaleReqType Complex Type

CheckSale transactions use bank account information as the payment method. There are sub-actions that can be taken as part of the CheckSale as indicated by the CheckAction field.

Note: Both GETI and Colonnade are supported. A check processor is chosen during the boarding process for each device. The choice of check processor will drive the available functionality as well as the required elements. See individual fields for additional information.

|

Sequence

|

|

All

|

CheckAction checkActionType Simple Type

A modifier that determines the backend functionality to perform; see the associated Type enumerations for specific values supported.

Note: Return and Override are only supported when processing with GETI.

Note: This sets the PACKET_ID sent to GETI.

|

|

AccountInfo optional AccountInfoType Complex Type

Account information to use as the payment method

Note: The check processor may allow MICR data to be sent in place of account and route or it may require both. This can be determined during certification.

|

|

DataEntryMode optional dataEntryModeType Simple Type

Indicates whether the provided data was entered manually or retrieved from a reader; see the associated Type enumerations for specific values supported.

Note: This sets the CONTROL_CHAR sent to GETI.

|

|

CheckType optional checkTypeType Simple Type

Indicates the type of check being processed; see the associated Type enumerations for specific values supported.

Note: This sets the IDENTIFIER sent to GETI.

|

|

VerifyInfo optional VerifyInfoType Complex Type

Verification only options

Note: If eBronze is selected as the SEC code for GETI during boarding, all requests will be verification only and this element is not required.

|

|

SECCode optional xs:string

NACHA Standard Entry Class Code for processing.

Valid values include:

- "PPD" (Prearranged Payment and Deposit)

- "CCD" (Cash Concentration or Disbursement)

- "POP" (GETI only, Point of Purchase Entry)

- "WEB" (Internet Initiated Entry)

- "TEL" (Telephone Initiated Entry)

- "EBRONZE" (GETI only)

Note: SECCode is a required field when the check processor is Colonnade.

Note: For GETI, this will be used to validate information returned from GETI during the transaction. This validation is not done when EBRONZE is chosen.

|

|

ConsumerInfo optional ConsumerInfoType Complex Type

Information about the consumer.

Note: While all these are optional in the schema, the check processor may require some of these fields in specific circumstances. For additional information on this, please consult the requirements of the specific processor.

|

|

PaymentMethodKey optional guidType Simple Type

Unique key generated by PayPlan associated with a stored payment method

Note: When using PaymentMethodKey, the following fields should not be sent as part of the transaction as they will be obtained from previously stored data:

- DataEntryMode

- CheckType

- VerifyInfo

- SECCode

- ConsumerInfo

- RoutingNumber

- AccountNumber

|

|

TokenValue optional xs:string

Token used to replace payment method data (route, account, and MICR).

Note: Multi-use tokens are not yet supported on check transactions. This is currently only used for single-use tokens. Single-use tokens are provided by the SecureSubmit product and are primarily used in eCommerce situations.

| | | | |

|

|

Sequence

|

Block1 CheckQueryReqBlock1Type Complex Type

Contains a series of required and optional elements

Note: GatewayTxnId and ClientTxnId are mutually exclusive, but it is required that one of these fields be provided.

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the transaction to be queried.

|

|

ClientTxnId optional clientIdType Simple Type

Client generated transaction identifier sent in the request of the original transaction. This indicates the transaction to be queried.

Note: Client generated ids are critical for situations when the client never receives a response from the gateway.

| | | | |

|

CheckVoid PosCheckVoidReqType Complex Type

CheckVoid is used to cancel a previously successful CheckSale transaction. It can also be used to cancel a prior CheckSale transaction. This should be used in timeout situations or when a complete response is not received.

Note:CheckVoid transactions should be submitted within 31 days of the original transaction.

Note:If the CheckVoid also fails to return a complete response (likely due to a timeout), wait until connectivity is restored and try again or contact support to ensure the proper result was achieved. CheckQuery can be used to check the status of a prior CheckSale transaction.

|

Sequence

|

Block1 CheckVoidReqBlock1Type Complex Type

Contains a series of required and optional elements

Note: GatewayTxnId and ClientTxnId are mutually exclusive, but it is required that one of these fields be provided.

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the transaction to be updated.

|

|

ClientTxnId optional clientIdType Simple Type

Client generated transaction identifier sent in the request of the original transaction. This indicates the transaction to be updated.

Note: Client generated ids are critical for situations when the client never receives a response from the gateway.

| | | | |

|

ChipCardDecline PosChipCardDeclineReqType Complex Type

ChipCardDecline is used to record an offline decline by an EMV chip card.This transaction is optional and can be used for record-keeping purposes only.

Note:This transaction is not used for a transaction that received an online approval. To cancel transactions that have been approved online but subsequently declined by the chip, a Credit/Debit Reversal must be sent.

|

All

|

|

All

|

CardData CardDataType Complex Type

A common element used in several different transactions for supplying payment method information.

This includes a choice of typical payment representations like track data, manually entered data, and token information. It also includes options for specifying how the supplied data has been encrypted.

Note: Multi-use tokens cannot be requested on a ChipCardDecline.

|

|

Amt amtTypeGlobal Simple Type

The amount requested for authorization; this includes all other "Info" amounts provided as part of this request.

|

|

GratuityAmtInfo optional amtTypeGlobal Simple Type

Gratuity amount information; this defines the portion of the total amount provided as part of this request that was specifically for gratuity. This is informational only and will not alter the amount processed as part of the transaction.

|

|

CPCReq optional booleanType Simple Type

This is used to request the issuer to return whether or not the supplied card is a commercial card

Note: See the CPCInd in the corresponding response transaction detail.

|

|

AllowDup optional booleanType Simple Type

This is important in cases where the client processes a large number of similar transactions in a very short period of time; sending "Y" will skip duplicate checking on this transaction

|

|

Ecommerce optional eCommerceType Simple Type

Identifies this transaction as eCommerce or mail order/telephone order; see the associated Type enumerations for specific values supported.

|

|

ConvenienceAmtInfo optional amtTypeGlobal Simple Type

Convenience fee amount information; this defines the portion of the total amount provided as part of this request that was specifically for a convenience fee. This is informational only and will not alter the amount processed as part of the transaction.

|

|

ShippingAmtInfo optional amtTypeGlobal Simple Type

Shipping amount information; this defines the portion of the total amount provided as part of this request that was specifically for shipping. This is informational only and will not alter the amount processed as part of the transaction.

|

|

SurchargeAmtInfo optional amtTypeGlobal Simple Type

Surcharge amount information; this defines the portion of the total amount provided as part of this request that was specifically for a surcharge. This is informational only and will not alter the amount processed as part of the transaction.

|

| | | |

|

CreditAccountVerify PosCreditAccountVerifyReqType Complex Type

CreditAccountVerify is used to verify that the associated account is in good standing with the Issuer. This is a zero dollar transaction with no associated authorization.

Note:UnionPay cards do not support Verification when routing directly to UnionPay International for approval. UnionPay cards routing through either the Discover or JCB networks may obtain verification. (UnionPay direct routing available for Canada merchants on the GSAP authorization platform only).

|

All

|

|

All

|

CardData optional CardDataType Complex Type

A common element used in several different transactions for supplying payment method information.

This includes a choice of typical payment representations like track data, manually entered data, and token information. It also includes options for specifying how the supplied data has been encrypted or to request a multi-use token be supplied in the response.

|

|

PaymentMethodKey optional guidType Simple Type

Unique key generated by PayPlan associated with a stored payment method

Note: When using a key, card data should not be sent. However, stored customer data can be overridden using the card holder data.

|

|

PaymentMethodKeyData optional PaymentMethodKeyData Complex Type

These fields provide a way to override stored payment information or to provide additional information in card present situations. This is for the current transaction only and will not be stored for future use.

Note: This element is only valid when supplying a PaymentMethodKey.

|

|

EMVData optional EMVDataType Complex Type

When processing with an EMV capable client, this element may need to be provided. It consists of certain online authentication data or the reason for not utilizing the EMV capabilities. EMV tag data should be sent in the separate TagData field.

|

|

CPCReq optional booleanType Simple Type

This is used to request the issuer to return whether or not the supplied card is a commercial card

Note: See the CPCInd in the corresponding response transaction detail.

|

|

TxnDescriptor optional TxnDescriptorType Simple Type

Transaction description that is concatenated to a configurable merchant DBA name. The resulting string is sent to the card issuer as the Merchant Name.

Note: Updates to the device are required to utilize this feature. See your Heartland representative for more details.

| | | | |

|

CreditAdditionalAuth PosCreditAdditionalAuthReqType Complex Type

CreditAdditionalAuth is typically used in a bar or restaurant situation where the merchant obtains the payment information for an original CreditAuth but does not want to hold the card or ask for it on each additional authorization.

This uses data from a previously successful CreditAuth to authorize an additional amount. The additional authorization is run as a card not present transaction and cannot be placed in a batch. This can be repeated as needed. The final settlement amount including any additional authorized amounts must be provided in the CreditAddToBatch for the original CreditAuth. When the original transaction is added to the batch a reversal is automatically attempted for all additional authorizations.

The following rules apply:

- CreditAdditionalAuth is allowed only for restaurant merchants.

- The original transaction must be an approved open authorization run within the same day (i.e. a CreditAuth that has not been added to a batch).

- When the original authorization transaction is fully reversed or voided, any associated CreditAdditionalAuth transactions are reversed.

- An original authorization transaction with CreditAdditionalAuth transactions can be partially reversed for less than the full original auth amount. However, additional authorizations are still not reversed until the original is added to the batch.

- Additional authorizations cannot be voided, edited, or used for returns.

Note:CreditAdditionalAuth is not supported for UnionPay cards routing to UnionPay International for authorization. CreditAdditionalAuth may continue to be used for UnionPay cards routing through either the Discover or JCB networks. (UnionPay direct routing available for Canada merchants on the GSAP authorization platform only).

Note:This service has been deprecated. Refer to CreditIncrementalAuth.

|

All

|

|

All

|

AllowDup optional booleanType Simple Type

This is important in cases where the client processes a large number of similar transactions in a very short period of time; sending "Y" will skip duplicate checking on this transaction.

|

|

TxnDescriptor optional TxnDescriptorType Simple Type

Transaction description that is concatenated to a configurable merchant DBA name. The resulting string is sent to the card issuer as the Merchant Name.

Note: Updates to the device are required to utilize this feature. See your Heartland representative for more details.

| | | | |

|

CreditAddToBatch PosCreditAddToBatchReqType Complex Type

CreditAddToBatch is primarily used to add a previously approved open authorization (CreditAuth, CreditOfflineAuth, OverrideFraudDecline, or RecurringBillingAuth) to the current open batch. If a batch is not open this transaction will create one. It also provides the opportunity to alter data associated with the transaction (i.e. add a tip amount).

Note: The gateway will not submit an authorization or reversal when the settlement amount of a transaction is altered. The client is responsible for managing these adjustments as needed.

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the transaction to be updated.

|

|

Amt optional amtTypeGlobal Simple Type

If present, this amount replaces the amount to be settled for the original transaction; this includes all other "Info" amounts associated with the original transaction or provided in this request.

|

|

GratuityAmtInfo optional amtTypeGlobal Simple Type

If present, this amount is stored with the original transaction. If the original already had gratuity amount information, this will replace it. This defines the portion of the settlement amount that is specifically for gratuity. This is informational only and will not alter the amount processed as part of the transaction.

|

|

|

All

|

Duration optional xs:int

Duration of stay in days

The stay Duration range is from 1 to 99.

|

|

ExtraChargeAmtInfo optional amtTypeGlobal Simple Type

Total extra charge amount information; this defines the portion of the total amount provided as part of this request that was specifically for lodging extra charges. This is informational only and will not alter the amount processed as part of the transaction.

|

| |

|

|

All

|

FuelUnitOfMeasure optional FuelUnitOfMeasureType Simple Type

Unit of measure for the fuel item purchased (can include EV charging).

Valid values include:

- 1 - Gallons

- 2 - Liters

- 3 - Pounds

- 4 - Kilos

- 5 - Imperial Gallons

- 6 - Kilowatt hour

- 7 - Minutes

- 8 - Hours

|

|

FuelAmtInfo optional amtTypeGlobal Simple Type

Fuel amount information; this defines the portion of the total amount provided as part of this request that was specifically for fuel. This is informational only and will not alter the amount processed as part of the transaction. Value must be greater than zero.

|

|

FuelSvcType optional FuelSvcType Simple Type

Indicates whether the fuel service is self-service or full service or only non-fuel products were purchased.

Valid values include:

- 0 - Undefined

- 1 - Self-service

- 2 - Full service

- 3 - Only non-fuel products being purchased

|

| |

|

|

All

| |

|

SurchargeAmtInfo optional amtTypeGlobal Simple Type

If present, this amount is stored with the original transaction. If the original already had surcharge amount information, this will replace it. This defines the portion of the settlement amount that is specifically for a surcharge. This is informational only and will not alter the amount processed as part of the transaction.

Note: This field is limited to 8 digits with implied decimal.

|

|

EMVTagData optional emvTagDataType Simple Type

EMV tag data in TLV format consisting of the chip card results after applying the Issuer response tags.

Note: This field has been obsoleted.See the TagData field for the alternative.

|

|

TagData optional TagDataType Complex Type

EMV or Non-EMV tag data in TLV format. For EMV tag data this would consist of the chip card results after applying the Issuer response tags.

|

All

|

TagValues optional Extension of xs:string

This field holds the tag data values.

| | |

|

|

All

|

PFRecAccountNbr Restriction of xs:long

Account number of the merchant who will receive the secondary amount.

|

| |

|

RetryInd optional booleanType Simple Type

Indicates whether this transaction is a retry of the previous CreditAddToBatch request.

Note: This is for the UK market only.

|

|

NoShow optional booleanType Simple Type

Indicates that this charge is due to a "no show" on a reservation

Note: This is for the UK and AP markets only.

|

|

|

All

|

CurrConvOptOutFlag booleanType Simple Type

This setting indicates if the Customer has decided Opt Out of currency conversion and have the amount remain in the Merchants currency. If the customer does not opt out, the amount will be converted to currency associated with the card.

|

|

RateLookupTxnId optional guidType Simple Type

The Retrieval Reference Number (RRN) of the RateLookup or Incremental Authorization that provided the rate used for the calculations in this transaction, if it is different from the original Authorization.

|

|

MarkupFee optional Restriction of xs:decimal

The mark up percentage applied to the transaction, resulting in the commission fee.

| | | | |

|

CreditAuth PosCreditAuthReqType Complex Type

CreditAuth authorizes a credit card transaction. These authorization only transactions are not added to the batch to be settled. They can be added to a batch at a later time using CreditAddToBatch. Approved authorizations that have not yet been added to a batch are called open auths.

Note: If you prefer to have the authorization automatically added to the batch, use CreditSale.

Authorizations can be processed by sending card data, the GatewayTxnId from a previous authorization, or a key from a previously stored payment method.

When using a prior transaction id, the following rules apply:

- The original transaction must be an approved CreditAuth or CreditSale that was not also run using a prior transaction id.

- The original transaction must be fully reversed, voided, or returned.

- The original transaction must have occurred within the last 14 days.

- The original transaction may only be referenced once in this way.

- The new amount must be greater than 0.00 and cannot exceed 100% of the original.

- The new transaction is sent as "Card Not Present"

- The new transaction can be voided or reversed.

- OrigTxnRefData must be provided with AuthCode and/or CardNbrLastFour and the provided data must match the original transaction data.

|

All

|

Block1 CreditAuthReqBlock1Type Complex Type

Contains a series of required and optional elements

Note: CardData, GatewayTxnId, and PaymentMethodKey are mutually exclusive, but it is required that one of these elements be provided.

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the transaction from which card data will be reused.

Note: When using a prior transaction id, card data should not be sent and original transaction reference data will be required.

|

|

CardData optional CardDataType Complex Type

A common element used in several different transactions for supplying payment method information.

This includes a choice of typical payment representations like track data, manually entered data, and token information. It also includes options for specifying how the supplied data has been encrypted or to request a multi-use token be supplied in the response.

|

|

PaymentMethodKey optional guidType Simple Type

Unique key generated by PayPlan associated with a stored payment method

Note: When using a key, card data should not be sent. However, stored customer data can be overridden using the card holder data.

|

|

PaymentMethodKeyData optional PaymentMethodKeyData Complex Type

These fields provide a way to override stored payment information or to provide additional information in card present situations. This is for the current transaction only and will not be stored for future use.

Note: This element is only valid when supplying a PaymentMethodKey.

|

|

Amt amtTypeGlobal Simple Type

The amount requested for authorization; this includes all other "Info" amounts provided as part of this request.

|

|

AmountIndicator optional amountIndicatorType Simple Type

Valid values include:

- 'E' indicates that Amt is an estimated amount

- 'F' indicates the Amt is final

Note: In the case of 'F', the Amt should not be manipulated and no CreditIncrementalAuth should be ran.

|

|

GratuityAmtInfo optional amtTypeGlobal Simple Type

Gratuity amount information; this defines the portion of the total amount provided as part of this request that was specifically for gratuity. This is informational only and will not alter the amount processed as part of the transaction.

|

|

PinBlock optional pinBlockType Simple Type

PIN block generated from the encrypted cardholder PIN and key serial number (KSN); see the guide for the specific PIN pad device being used to determine how to obtain the data elements required to create a PIN block.

Note: Only used for UnionPay transactions processing to the GSAP-NA and GSAP-AP authorization platforms. Not for use with EMV transactions. Refer to EMVData.

|

|

CPCReq optional booleanType Simple Type

This is used to request the issuer to return whether or not the supplied card is a commercial card

Note: See the CPCInd in the corresponding response transaction detail.

|

|

AllowDup optional booleanType Simple Type

This is important in cases where the client processes a large number of similar transactions in a very short period of time; sending "Y" will skip duplicate checking on this transaction

|

|

AllowPartialAuth optional booleanType Simple Type

Indicates whether or not a partial authorization is supported by terminal; the default is N.

Note:This field is ignored for merchants processing via FEVO.

|

|

Ecommerce optional eCommerceType Simple Type

Identifies this transaction as eCommerce or mail order/telephone order; see the associated Type enumerations for specific values supported.

|

|

OrigTxnRefData optional origTxnRefDataType Complex Type

This element is required when a GatewayTxnId is used instead of card data. At least one of the sub-fields must be supplied. Any supplied data must match the corresponding data on the original transaction being referenced.

|

|

ConvenienceAmtInfo optional amtTypeGlobal Simple Type

Convenience fee amount information; this defines the portion of the total amount provided as part of this request that was specifically for a convenience fee. This is informational only and will not alter the amount processed as part of the transaction.

|

|

ShippingAmtInfo optional amtTypeGlobal Simple Type

Shipping amount information; this defines the portion of the total amount provided as part of this request that was specifically for shipping. This is informational only and will not alter the amount processed as part of the transaction.

|

|

TxnDescriptor optional TxnDescriptorType Simple Type

Transaction description that is concatenated to a configurable merchant DBA name. The resulting string is sent to the card issuer as the Merchant Name.

Note: Updates to the device are required to utilize this feature. See your Heartland representative for more details.

|

|

SurchargeAmtInfo optional amtTypeGlobal Simple Type

Surcharge amount information; this defines the portion of the total amount provided as part of this request that was specifically for a surcharge. This is informational only and will not alter the amount processed as part of the transaction.

Note: This field is limited to 8 digits with implied decimal.

|

|

EMVData optional EMVDataType Complex Type

When processing with an EMV capable client, this element may need to be provided. It consists of certain online authentication data or the reason for not utilizing the EMV capabilities. EMV tag data should be sent in the separate TagData field.

|

|

SecureECommerce optional SecureECommerceType Complex Type

Allows for sending Secure ECommerce data associated with the transaction. This data must be obtained from a certified device that conform to the 3DSecure standard.

NOTE: This functionality is deprecated. All new integrations are expected to use the Secure3D and, where applicable, WalletData blocks. All existing integrations to SecureECommerce need to be updated to use the new data block(s).

|

|

BillPay optional booleanType Simple Type

Indicates whether or not the transaction is a bill payment.

Merchants requiring Bill Payments should use RecurringBilling.

|

|

IPSelectedTerms optional IPSelectedTermsReqType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider.

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada must provide the Program and VISOptions.

For Visa Installment Service (VIS) merchants must provide VISPlanOptions and Program.

|

|

EUSingleTap optional booleanType Simple Type

This field provides a way for a European merchant to indicate whether a transaction is a Single Tap contactless transaction, or whether the request contains an intentionally duplicated (replayed) ATC value. Applies to MC transactions only. Valid values: Y - SingleTap N - ReplayedATC

|

|

ExtendedAuthInd optional booleanType Simple Type

For Visa cards only. On eCommerce cardholder-initiated transactions (CIT), requests that the issuer extend the authorization validity up to 30 days.

Note: Supported for the GSAP-NA host only as this time.

| | | | |

|

|

|

CreditCPCEdit PosCreditCPCEditReqType Complex Type

CreditCPCEdit attaches Corporate Purchase Card (CPC) data to a prior transaction. This information will be passed to the issuer at settlement when the associated card was a corporate card or an AMEX card.

Note: This function only works against previously approved CreditAuth, CreditSale, CreditOfflineAuth, CreditOfflineSale, RecurringBilling, and RecurringBillingAuth transactions.

Note: The amount of the original transaction is not altered by the CreditCPCEdit. This additional data is informational only. The original transaction will be processed regardless of whether or not the CreditCPCEdit is used by the client.

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the transaction to be updated.

|

|

|

All

|

TaxType optional taxTypeType Simple Type

Tax type indicator that qualifies the associated tax amount, see the associated Type enumerations for specific values supported.

|

|

TaxAmt optional amtTypeGlobal Simple Type

Tax amount

Note: If the tax type is 'TaxExempt', an amount should not be provided. If it is, the gateway discards the amount.

|

| |

| |

|

CreditIncrementalAuth PosCreditIncrementalAuthReqType Complex Type

CreditIncrementalAuth adds to the authorized amount for a prior transaction.

The following rules apply:

- The original transaction must be an approved CreditAuth.

- Note: CreditSale is allowed for US merchants processing to the Exchange host only.The original transaction id should continue to be used for subsequent transactions (i.e., voids, reversals, edits, etc.); the transaction id of the incremental authorization should never be referred to by subsequent transactions.

- Each incremental authorization is not added to the batch. The total amount is maintained with the original transaction.

- If the final settlement amount of the original transaction is less than the total of all authorizations, reversals will automatically be generated as needed.

Note:UnionPay cards routed directly to UnionPay International do not support Incremental Authorizations. CreditIncrementalAuth may be used for UnionPay the Discover or JCB networks. (available merchants on the GSAP authorization platform only).

|

All

|

|

All

|

LodgingData optional ExtraChargesDataType Complex Type

Lodging extra charge indicators; common group of elements that provide additional details specific to lodging transactions that may be required in certain situations as determined by the brands

Note: The field name LodgingData can be confusing in this case as it is actually referring to the lodging extra charges data type.

|

|

CardOnFileData optional CardOnFileDataType Complex Type

Card On File Data

For Credit Incremental Auth transactions, this data is used for Exchange-hosted merchants only. For GSAP, GNAP, and AP hosted merchants, the card on file data is obtained from the original Credit Auth being incremented.

|

| | | |

|

|

All

|

|

All

|

CardData optional CardDataType Complex Type

A common element used in several different transactions for supplying payment method information.

This includes a choice of typical payment representations like track data, manually entered data, and token information. It also includes options for specifying how the supplied data has been encrypted or to request a multi-use token be supplied in the response.

|

|

CPCReq optional booleanType Simple Type

This is used to request the issuer to return whether or not the supplied card is a commercial card

Note: See the CPCInd in the corresponding response transaction detail.

|

|

PaymentMethodKey optional guidType Simple Type

Unique key generated by PayPlan associated with a stored payment method

Note: When using a key, card data should not be sent. However, stored customer data can be overridden using the card holder data.

|

|

Ecommerce optional eCommerceType Simple Type

Identifies this transaction as eCommerce or mail order/telephone order; see the associated Type enumerations for specific values supported.

|

|

EMVData optional EMVDataType Complex Type

When processing with an EMV capable client, this element may need to be provided. It consists of certain online authentication data or the reason for not utilizing the EMV capabilities. EMV tag data should be sent in the separate TagData field.

|

|

IPTerms optional IPTermsReqDataType Complex Type

The IPTerms block include information regarding the installment Program.

For Visa Installments Service (VIS), multiple plans are returned in the response. The VISOptions block includes additional filter options for the returned plans.

| | | | |

|

CreditOfflineAuth PosCreditOfflineAuthReqType Complex Type

CreditOfflineAuth records an authorization obtained outside of the gateway (e.g., voice authorization, chip card offline approval). These authorization only transactions are not added to the batch to be settled. They can be added to a batch at a later time using CreditAddToBatch. Approved authorizations that have not yet been added to a batch are called open auths.

Note:Depending on the Host Processor, a CreditOfflineAuth transaction may not be modified after it has been added to a batch.

|

All

|

|

All

|

Amt amtTypeGlobal Simple Type

The amount requested for authorization; this includes all other "Info" amounts provided as part of this request.

|

|

GratuityAmtInfo optional amtTypeGlobal Simple Type

Gratuity amount information; this defines the portion of the total amount provided as part of this request that was specifically for gratuity. This is informational only and will not alter the amount processed as part of the transaction.

|

|

CPCReq optional booleanType Simple Type

This is used to request the issuer to return whether or not the supplied card is a commercial card.

Note: This is not used in offlines.

|

|

AllowDup optional booleanType Simple Type

This is important in cases where the client processes a large number of similar transactions in a very short period of time; sending "Y" will skip duplicate checking on this transaction.

|

|

Ecommerce optional eCommerceType Simple Type

Identifies this transaction as eCommerce or mail order/telephone order; see the associated Type enumerations for specific values supported.

|

|

ConvenienceAmtInfo optional amtTypeGlobal Simple Type

Convenience fee amount information; this defines the portion of the total amount provided as part of this request that was specifically for a convenience fee. This is informational only and will not alter the amount processed as part of the transaction.

|

|

ShippingAmtInfo optional amtTypeGlobal Simple Type

Shipping amount information; this defines the portion of the total amount provided as part of this request that was specifically for shipping. This is informational only and will not alter the amount processed as part of the transaction.

|

|

SurchargeAmtInfo optional amtTypeGlobal Simple Type

Surcharge amount information; this defines the portion of the total amount provided as part of this request that was specifically for a surcharge. This is informational only and will not alter the amount processed as part of the transaction.

Note: This field is limited to 8 digits with implied decimal.

|

|

EMVTagData optional emvTagDataType Simple Type

EMV tag data in TLV format; used for chip card offline approvals.

Note: This field has been obsoleted.See the TagData field for the alternative.

|

| | | |

|

CreditOfflineSale PosCreditOfflineSaleReqType Complex Type

CreditOfflineSale records an authorization obtained outside of the gateway (e.g., voice authorization, chip card offline approval). The authorization is placed in the current open batch. If a batch is not open this transaction will create one.

|

All

|

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction.

This field is used to indicate that the previous CreditOfflineSale that timed out should be retried.

Note: This is for the UK market only.

|

|

Amt amtTypeGlobal Simple Type

The amount requested for authorization; this includes all other "Info" amounts provided as part of this request.

|

|

GratuityAmtInfo optional amtTypeGlobal Simple Type

Gratuity amount information; this defines the portion of the total amount provided as part of this request that was specifically for gratuity. This is informational only and will not alter the amount processed as part of the transaction.

|

|

CPCReq optional booleanType Simple Type

This is used to request the issuer to return whether or not the supplied card is a commercial card.

Note: This is not used in offlines.

|

|

AllowDup optional booleanType Simple Type

This is important in cases where the client processes a large number of similar transactions in a very short period of time; sending "Y" will skip duplicate checking on this transaction.

|

|

Ecommerce optional eCommerceType Simple Type

Identifies this transaction as eCommerce or mail order/telephone order; see the associated Type enumerations for specific values supported.

|

|

ConvenienceAmtInfo optional amtTypeGlobal Simple Type

Convenience fee amount information; this defines the portion of the total amount provided as part of this request that was specifically for a convenience fee. This is informational only and will not alter the amount processed as part of the transaction.

|

|

ShippingAmtInfo optional amtTypeGlobal Simple Type

Shipping amount information; this defines the portion of the total amount provided as part of this request that was specifically for shipping. This is informational only and will not alter the amount processed as part of the transaction.

|

|

SurchargeAmtInfo optional amtTypeGlobal Simple Type

Surcharge amount information; this defines the portion of the total amount provided as part of this request that was specifically for a surcharge. This is informational only and will not alter the amount processed as part of the transaction.

Note: This field is limited to 8 digits with implied decimal.

|

|

EMVTagData optional emvTagDataType Simple Type

EMV tag data in TLV format; used for chip card offline approvals.

Note: This field has been obsoleted.See the TagData field for the alternative.

|

| | | |

|

CreditReturn PosCreditReturnReqType Complex Type

CreditReturn allows the merchant to return funds back to the cardholder. Returns can be for the entire amount associated with the original sale or a partial amount. The transaction is placed in the current open batch. If a batch is not open, this transaction creates an open batch.

For added fraud protection, CreditReturn can be run utilizing the GatewayTxnId from a previous sale. When this feature is used, the gateway tracks returns against the original sale and applies several rules.

The following rules apply when returning by GatewayTxnId:

- The original transaction must be a CreditAuth, CreditSale, CreditOfflineAuth, CreditOfflineSale, RecurringBilling, or RecurringBillingAuth and must be in a batch. It cannot be an open authorization that still needs to be added to a batch.

- The total of all returns cannot exceed the original sale amount. This is true for processing a single return as well as multiple returns against the same original transaction.

- A return amount must be greater than zero.

- The return must be run within 1 year.

- CreditReversal, CreditVoid, and CreditTxnEdit are not allowed against original transactions for which a full or partial return has been run.

- A return can be voided. If this results in the total return amount being adjusted back to zero, CreditVoid, CreditReversal, and CreditTxnEdit are allowed on the original transaction once again.

- If CardData is also supplied, the supplied card number and the card number of the original transaction must match.

Note: If the original transaction is in the current open batch, a CreditVoid or CreditReversal may be used instead. However, only a return can be used once the batch is closed.

|

All

|

Block1 CreditReturnReqBlock1Type Complex Type

Contains a series of required and optional elements

Note: One or both of CardData and GatewayTxnId can be supplied, but it is required that one of these elements be provided.

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the original sale this return is to be run against.

Note: If CardData is also sent, the provided data must match the original.

|

|

AuthCode optional authCodeType Simple Type

Authorization code returned by the Issuer on the original transaction. Supported for GSAP-hosted merchants only; necessary for returns in Mexico.

|

|

PinBlock optional pinBlockType Simple Type

PIN block generated from the encrypted cardholder PIN and key serial number (KSN); see the guide for the specific PIN pad device being used to determine how to obtain the data elements required to create a PIN block.

Note: Only used for UnionPay transactions processing to the GSAP-NA and GSAP-AP authorization platforms. Not for use with EMV transactions. Refer to EMVData.

|

|

AllowDup optional booleanType Simple Type

This is important in cases where the client processes a large number of similar transactions in a very short period of time; sending "Y" will skip duplicate checking on this transaction

|

|

Ecommerce optional eCommerceType Simple Type

Identifies this transaction as eCommerce or mail order/telephone order; see the associated Type enumerations for specific values supported.

|

|

SurchargeAmtInfo optional amtTypeGlobal Simple Type

Surcharge amount information; this defines the portion of the total amount provided as part of this request that was specifically for a surcharge. This is informational only and will not alter the amount processed as part of the transaction.

Note: This field is limited to 8 digits with implied decimal.

|

|

EMVData optional EMVDataType Complex Type

When processing with an EMV capable client, this element may need to be provided. It consists of certain online authentication data or the reason for not utilizing the EMV capabilities. EMV tag data should be sent in the separate TagData field.

|

|

TxnDescriptor optional TxnDescriptorType Simple Type

Transaction description that is concatenated to a configurable merchant DBA name. The resulting string is sent to the card issuer as the Merchant Name.

Note: Updates to the device are required to utilize this feature. See your Heartland representative for more details.

| | | | |

|

CreditReversal PosCreditReversalReqType Complex Type

CreditReversal cancels a prior authorization in the current open batch. This can be used in timeout situations or when a complete response is not received, and may also be used to partially reduce the amount of a prior authorization. This transaction can also be used to cancel a transaction that was approved online but subsequently declined by the chip.

CreditReversal can be used on prior transactions of the following types: CreditAuth, CreditSale, CreditOfflineAuth, CreditOfflineSale, RecurringBilling, RecurringBillingAuth, and OverrideFraudDecline.

Note: Credit reversal transactions must be submitted within 31 days of the original transaction.

Note: For American Express cards, the authorized amount must be sent as an estimated amount.

Note: If the reversal also fails to return a complete response (likely due to a timeout), wait until connectivity is restored and try again or contact support to ensure the proper result was achieved.

Note: A credit reversal should be requested with the GatewayTxnID or ClientTxnID. Never send a reversal request with a multi-use token in the Card Data.

|

All

|

Block1 CreditReversalReqBlock1Type Complex Type

Contains a series of required and optional elements

Note: CardData, ClientTxnId, and GatewayTxnId are mutually exclusive, but it is required that one of these fields be provided.

Note: Always run reversals with either GatewayTxnId or ClientTxnId. If only CardData is used the results are not guaranteed as the original transaction may not be uniquely identified.

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the transaction to be updated.

|

|

CardData optional CardDataType Complex Type

A common element used in several different transactions for supplying payment method information.

This includes a choice of typical payment representations like track data, manually entered data, and token information. It also includes options for specifying how the supplied data has been encrypted or to request a multi-use token be supplied in the response.

|

|

Amt amtTypeGlobal Simple Type

This must match the authorization amount from the original transaction. This is required for both full and partial reversals. If not supplied an error response will be returned.

|

|

AuthAmt optional amtTypeGlobal Simple Type

This field is required for a partial reversal and indicates the desired new authorization amount once the reversal has been processed. If not supplied it will be defaulted to zero indicating a full reversal.

|

|

Ecommerce optional eCommerceType Simple Type

Identifies this transaction as eCommerce or mail order/telephone order; see the associated Type enumerations for specific values supported.

|

|

ClientTxnId optional clientIdType Simple Type

Client generated transaction identifier sent in the request of the original transaction. This indicates the transaction to be updated.

Note: Client generated ids are critical for situations when the client never receives a response from the gateway.

|

|

EMVTagData optional emvTagDataType Simple Type

When processing with an EMV capable client, this element may need to be provided. It consists of certain online authentication data or the reason for not utilizing the EMV capabilities. EMV tag data should be sent in the separate TagData field.

Note: This field has been obsoleted.See the TagData field for the alternative.

|

| | | |

|

CreditSale PosCreditSaleReqType Complex Type

CreditSale authorizes a credit card transaction. These authorizations are automatically added to the batch to be settled. If a batch is not already open this transaction will create one.

Authorizations can be processed by sending card data or the GatewayTxnId from a previous authorization. When using a prior transaction id, the following rules apply:

- The original transaction must be an approved CreditAuth or CreditSale that was not also run using a prior transaction id.

- The original transaction must be fully reversed, voided, or returned.

- The original transaction must have occurred within the last 14 days.

- The original transaction may only be referenced once in this way.

- The new amount must be greater than 0.00 and cannot exceed 100% of the original.

- The new transaction is sent as "Card Not Present"

- The new transaction can be voided or reversed.

- OrigTxnRefData must be provided with AuthCode and/or CardNbrLastFour and the provided data must match the original transaction data.

|

All

|

Block1 CreditSaleReqBlock1Type Complex Type

Contains a series of required and optional elements

Note: CardData and GatewayTxnId are mutually exclusive, but it is required that one of these elements be provided.

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the transaction from which card data will be reused.

Note: When using a prior transaction id, card data should not be sent and original transaction reference data will be required.

|

|

CardData optional CardDataType Complex Type

A common element used in several different transactions for supplying payment method information.

This includes a choice of typical payment representations like track data, manually entered data, and token information. It also includes options for specifying how the supplied data has been encrypted or to request a multi-use token be supplied in the response.

|

|

PaymentMethodKey optional guidType Simple Type

Unique key generated by PayPlan associated with a stored payment method

Note: When using a key, card data should not be sent. However, stored customer data can be overridden using the card holder data.

|

|

PaymentMethodKeyData optional PaymentMethodKeyData Complex Type

These fields provide a way to override stored payment information or to provide additional information in card present situations. This is for the current transaction only and will not be stored for future use.

Note: This element is only valid when supplying a PaymentMethodKey.

|

|

Amt amtTypeGlobal Simple Type

The amount requested for authorization; this includes all other "Info" amounts provided as part of this request.

|

|

AmountIndicator optional amountIndicatorType Simple Type

Valid values include:

- 'E' indicates that Amt is an estimated amount

- 'F' indicates the Amt is final

Note: In the case of 'F', the Amt should not be manipulated and no CreditIncrementalAuth should be ran.

|

|

GratuityAmtInfo optional amtTypeGlobal Simple Type

Gratuity amount information; this defines the portion of the total amount provided as part of this request that was specifically for gratuity. This is informational only and will not alter the amount processed as part of the transaction.

|

|

PinBlock optional pinBlockType Simple Type

PIN block generated from the encrypted cardholder PIN and key serial number (KSN); see the guide for the specific PIN pad device being used to determine how to obtain the data elements required to create a PIN block.

Note: Only used for UnionPay transactions processing to the GSAP-NA and GSAP-AP authorization platforms. Not for use with EMV transactions. Refer to EMVData.

|

|

CPCReq optional booleanType Simple Type

This is used to request the issuer to return whether or not the supplied card is a commercial card.

Note: See the CPCInd in the corresponding response transaction detail.

|

|

AllowDup optional booleanType Simple Type

This is important in cases where the client processes a large number of similar transactions in a very short period of time; sending "Y" will skip duplicate checking on this transaction

|

|

AllowPartialAuth optional booleanType Simple Type

Indicates whether or not a partial authorization is supported by terminal; the default is N.

Note:This field is ignored for merchants processing via FEVO.

|

|

Ecommerce optional eCommerceType Simple Type

Identifies this transaction as eCommerce or mail order/telephone order; see the associated Type enumerations for specific values supported.

|

|

OrigTxnRefData optional origTxnRefDataType Complex Type

This element is required when a GatewayTxnId is used instead of card data. At least one of the sub-fields must be supplied. Any supplied data must match the corresponding data on the original transaction being referenced.

|

|

ConvenienceAmtInfo optional amtTypeGlobal Simple Type

Convenience fee amount information; this defines the portion of the total amount provided as part of this request that was specifically for a convenience fee. This is informational only and will not alter the amount processed as part of the transaction.

|

|

ShippingAmtInfo optional amtTypeGlobal Simple Type

Shipping amount information; this defines the portion of the total amount provided as part of this request that was specifically for shipping. This is informational only and will not alter the amount processed as part of the transaction.

|

|

TxnDescriptor optional TxnDescriptorType Simple Type

Transaction description that is concatenated to a configurable merchant DBA name. The resulting string is sent to the card issuer as the Merchant Name.

Note: Updates to the device are required to utilize this feature. See your Heartland representative for more details.

|

|

SurchargeAmtInfo optional amtTypeGlobal Simple Type

Surcharge amount information; this defines the portion of the total amount provided as part of this request that was specifically for a surcharge. This is informational only and will not alter the amount processed as part of the transaction.

Note: This field is limited to 8 digits with implied decimal.

|

|

EMVData optional EMVDataType Complex Type

When processing with an EMV capable client, this element may need to be provided. It consists of certain online authentication data or the reason for not utilizing the EMV capabilities. EMV tag data should be sent in the separate TagData field.

|

|

SecureECommerce optional SecureECommerceType Complex Type

Allows for sending Secure ECommerce data associated with the transaction. This data must be obtained from a certified device that conform to the 3DSecure standard.

NOTE: This functionality is deprecated. All new integrations are expected to use the Secure3D and, where applicable, WalletData blocks. All existing integrations to SecureECommerce need to be updated to use the new data block(s).

|

|

CashbackAmtInfo optional amtTypeGlobal Simple Type

Cashback amount information; this defines the portion of the total amount provided as part of this request that was specifically for cashback. This is informational only and will not alter the amount processed as part of the transaction.

Note: This is only supported for the UK, AP, and Mexico markets only.

|

|

IPSelectedTerms optional IPSelectedTermsReqType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider.

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada must provide the Program and VISOptions.

For Visa Installment Service (VIS) merchants must provide VISPlanOptions and Program.

|

|

BillPay optional booleanType Simple Type

Indicates whether or not the transaction is a bill payment.

Merchants requiring Bill Payments should use RecurringBilling.

|

|

ServiceLocation optional ServiceLocationType Complex Type

Details of the location where services are provided, if different from the merchant’s location. Should be provided for Mastercard transactions where applicable.

Note: Currently only used by Mastercard.

|

|

EUSingleTap optional booleanType Simple Type

This field provides a way for a European merchant to indicate whether a transaction is a Single Tap contactless transaction, or whether the request contains an intentionally duplicated (replayed) ATC value. Applies to MC transactions only. Valid values: Y - SingleTap N - ReplayedATC

|

| | | |

|

CreditTxnEdit PosCreditTxnEditReqType Complex Type

CreditTxnEdit allows the merchant to alter the data on a previously approved CreditSale, CreditAuth, CreditOfflineSale, or CreditOfflineAuth (i.e. add a tip amount).

Note:Depending on the Host Processor, a CreditOfflineAuth transaction may not be modified after it has been added to a batch.

Note:The gateway will not submit an authorization or reversal when the settlement amount of a transaction is altered. The client is responsible for managing these adjustments as needed.

Note:Approved UnionPay authorizations routed directly to UnionPay International cannot be adjusted. UnionPay cards routing through either the Discover or JCB networks may be adjusted. (UnionPay direct routing available for Canada merchants on the GSAP authorization platform only).

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the transaction to be updated.

|

|

Amt optional amtTypeGlobal Simple Type

If present, this amount replaces the amount to be settled for the original transaction; this includes all other "Info" amounts associated with the original transaction or provided in this request.

|

|

GratuityAmtInfo optional amtTypeGlobal Simple Type

If present, this amount is stored with the original transaction. If the original already had gratuity amount information, this will replace it. This defines the portion of the settlement amount that is specifically for gratuity. This is informational only and will not alter the amount processed as part of the transaction.

|

|

|

All

|

Duration optional xs:int

Duration of stay in days

The stay Duration range is from 1 to 99.

|

|

ExtraChargeAmtInfo optional amtTypeGlobal Simple Type

Total extra charge amount information; this defines the portion of the total amount provided as part of this request that was specifically for lodging extra charges. This is informational only and will not alter the amount processed as part of the transaction.

|

| |

|

|

All

| |

|

SurchargeAmtInfo optional amtTypeGlobal Simple Type

If present, this amount is stored with the original transaction. If the original already had surcharge amount information, this will replace it. This defines the portion of the settlement amount that is specifically for a surcharge. This is informational only and will not alter the amount processed as part of the transaction.

Note: This field is limited to 8 digits with implied decimal.

|

|

EMVTagData optional emvTagDataType Simple Type

EMV Tag Data in TLV format consisting of the chip card results after applying the Issuer response tags.

Note: This field has been obsoleted.See the TagData field for the alternative.

|

|

TagData optional TagDataType Complex Type

EMV or Non-EMV tag data in TLV format. For EMV tag data this would consist of the chip card results after applying the Issuer response tags.

|

All

|

TagValues optional Extension of xs:string

This field holds the tag data values.

| | |

|

NoShow optional booleanType Simple Type

Indicates that this charge is due to a "no show" on a reservation

Note: This is for the UK and AP markets only.

|

|

|

All

|

CurrConvOptOutFlag booleanType Simple Type

This setting indicates if the Customer has decided Opt Out of currency conversion and have the amount remain in the Merchants currency. If the customer does not opt out, the amount will be converted to currency associated with the card.

|

|

RateLookupTxnId optional guidType Simple Type

The Retrieval Reference Number (RRN) of the RateLookup or Incremental Authorization that provided the rate used for the calculations in this transaction, if it is different from the original Authorization.

|

|

MarkupFee optional Restriction of xs:decimal

The mark up percentage applied to the transaction, resulting in the commission fee.

| | | | |

|

CreditVoid PosCreditVoidReqType Complex Type

CreditVoid is used to cancel an open auth or remove a transaction from the current open batch. The original transaction must be a CreditAuth, CreditSale, CreditReturn, CreditOfflineAuth, CreditOfflineSale, RecurringBilling, RecurringBillingAuth, or OverrideFraudDecline.

Note: Once a batch is closed, associated transactions can no longer be voided. In these cases, a CreditReturn can be used to adjust a customer's account.

Note: If a transaction has been fully or partially returned, it cannot be voided.

Note: Due to new issuer regulations, a void now automatically attempts to reverse the original transaction. If the reversal is successful, the original transaction status will be set to 'R'. If there is no need to reverse (i.e. offlines) or the reversal fails, the original transaction status will be set to 'V'. A successful response to the void will indicate that the original transaction has been removed from the batch in either case.

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the transaction to be updated.

|

| |

|

DebitAddValue PosDebitAddValueReqType Complex Type

DebitAddValue increases the amount on a stored value card. The transaction is placed in the current open batch. If a batch is not open, this transaction creates an open batch.

Note: This transaction has been obsoleted. See the PrePaidAddValue for an alternative.

|

All

|

|

All

|

PinBlock pinBlockType Simple Type

PIN block generated from the encrypted cardholder PIN and key serial number (KSN); see the guide for the specific PIN pad device being used to determine how to obtain the data elements required to create a PIN block.

Note: Portico requires the order of the data to be encrypted PIN followed by the KSN. If the encrypted PIN was 11111111 and the KSN was 22222222, the PIN block would have to be 1111111122222222 when sent to the gateway.

|

|

AllowDup optional booleanType Simple Type

This is important in cases where the client processes a large number of similar transactions in a very short period of time; sending "Y" will skip duplicate checking on this transaction.

|

| | | |

|

|

All

|

|

All

|

TokenValue optional xs:string

Token used to replace payment method data (track data and optionally PIN block).

Note: Multi-use tokens are not supported on debit transactions. This is currently only used for single-use tokens. Single-use tokens are provided by the SecureSubmit product and are primarily used in eCommerce situations.

|

|

EMVChipCondition optional emvChipConditionType Simple Type

This must be provided when the POS was not able to successfully communicate to the chip card and was required to fall back to a magnetic stripe read on an EMV capable terminal.

The values can indicate multiple factors:

- The EMV chip read failed

- Did the previous attempt fail

See enumerations for specific values supported

|

|

TagData optional TagDataType Complex Type

EMV or Non-EMV tag data in TLV format. For EMV tag data this would consist of the chip card results after applying the Issuer response tags.

|

| | | |

|

DebitReturn PosDebitReturnReqType Complex Type

DebitReturn allows the merchant to return funds from a prior debit sale back to the cardholder. Returns can be for the entire amount associated with the original sale or a partial amount. The transaction is placed in the current open batch. If a batch is not open, this transaction creates an open batch.

For added fraud protection, DebitReturn can be run utilizing the GatewayTxnId from a previous debit sale. When this feature is used, the gateway tracks returns against the original sale and applies several rules.

The following rules apply when returning by GatewayTxnId:

- The total of all returns cannot exceed the original sale amount. This is true for processing a single return as well as multiple returns against the same original transaction.

- A return amount must be greater than zero.

- DebitReversal is not allowed against original transactions for which a full or partial return has been run.

- The supplied card number (from the track data or token) and the card number of the original transaction must match.

Note: If the original transaction is in the current open batch, a DebitReversal may be used instead. However, only a return can be used once the batch is closed.

|

All

|

Block1 DebitReturnReqBlock1Type Complex Type

Contains a series of required and optional elements

Note: TokenValue and TrackData are mutually exclusive, but it is required that one of these elements be provided. PinBlock can either be sent as part of the request or it can be associated with a token but it must be provided as well.

|

All

|

GatewayTxnId optional txnIdType Simple Type

Gateway-generated transaction identifier returned in the response of the original transaction. This indicates the original debit sale this return is to be run against.

Note: For debit returns, information is not pulled from the original debit sale for processing. The client must provide the PIN block and track data (or a token). The original transaction data will be used to validate that the card is the same and the return is less than or equal to the original amount, including any other returns against that transaction.

|

|

|

|

PinBlock optional pinBlockType Simple Type

PIN block generated from the encrypted cardholder PIN and key serial number (KSN); see the guide for the specific PIN pad device being used to determine how to obtain the data elements required to create a PIN block.

Note: It is required that the order of the data be an encrypted PIN followed by the KSN. If the encrypted PIN was 11111111 and the KSN was 22222222, the PIN block would have to be 1111111122222222 when sent to the gateway.

|

|

TokenValue optional xs:string

Token used to replace payment method data (track data and optionally PIN block).

Note: Multi-use tokens are not supported on debit transactions. This is currently only used for single-use tokens. Single-use tokens are provided by the SecureSubmit product.

|

|

AllowDup optional booleanType Simple Type

This is important in cases where the client processes a large number of similar transactions in a very short period of time; sending "Y" will skip duplicate checking on this transaction.

|

|

EMVChipCondition optional emvChipConditionType Simple Type

This must be provided when the POS was not able to successfully communicate to the chip card and was required to fall back to a magnetic stripe read on an EMV capable terminal.

The values can indicate multiple factors:

- The EMV chip read failed

- Did the previous attempt fail