|

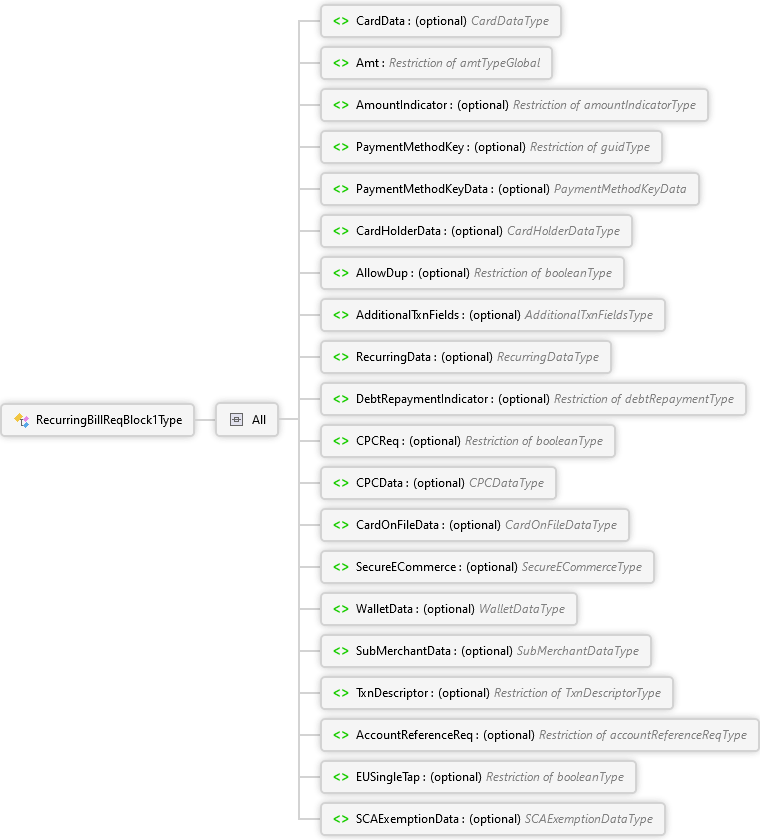

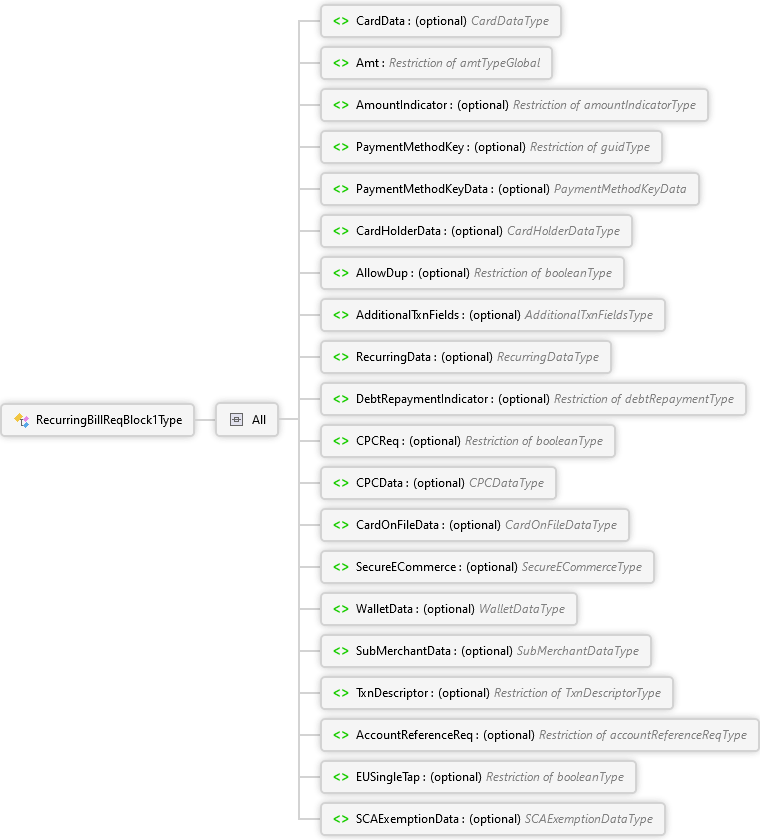

All

|

CardData optional CardDataType Complex Type

A common element used in several different transactions for supplying payment method information.

This includes a choice of typical payment representations like track data, manually entered data, and token information. It also includes options for specifying how the supplied data has been encrypted or to request a multi-use token be supplied in the response.

|

Sequence

|

Choice

|

TrackData CardDataTypeTrackData Complex Type

Track data is the full magnetic stripe data.

Note: TrackData is unique in that it has an attribute "method" that is used to indicate how the associated data was obtained.

|

method optional CardDataTypeTrackDataMethod Simple Type

Indicates the method by which the track data was obtained; see the associated Type enumerations for specific values supported

Note: If not provided, the method is assumed to be a typical card swipe. | |

|

ManualEntry

This is typically manually entered card data, but can be used in any case where only the card number is used rather than the full track.

|

All

|

CVV2 optional Restriction of cvv2Type Simple Type

CVV Number ("Card Verification Value"); 3 digits on VISA, MasterCard, Discover and UnionPay and 4 on American Express.

CVV numbers are also known as CSC numbers ("Card Security Code"), as well as CVV2 numbers, which are the same as CVV numbers, except that they have been generated by a 2nd generation process.

Note: This field is not used for EBT transactions.

|

|

CVV2Status optional cvv2Status Simple Type

Indicates why the CVV2 value was not provided; see the associated Type enumerations for specific values supported.

Note: This field is not used for EBT transactions.

| | |

|

TokenData

This is used when the card number from a previous transaction has been tokenized. This supports both multi-use and single-use tokens.

|

All

|

TokenValue xs:string

Multi-use or single-use token; used as a reference to a payment method for this transaction

|

|

ExpMonth optional monthType Simple Type

Card expiration month

Note: If expiration month and year are provided, they will be used for processing the transaction rather than the stored values associated with the provided token. This is for the current transaction only and will not be stored for future use.

|

|

CVV2 optional Restriction of cvv2Type Simple Type

CVV Number ("Card Verification Value"); 3 digits on VISA, MasterCard, Discover and UnionPay and 4 on American Express.

CVV numbers are also known as CSC numbers ("Card Security Code"), as well as CVV2 numbers, which are the same as CVV numbers, except that they have been generated by a 2nd generation process.

Note: This field is not used for EBT transactions.

|

|

CVV2Status optional cvv2Status Simple Type

Indicates why the CVV2 value was not provided; see the associated Type enumerations for specific values supported.

Note: This field is not used for EBT transactions.

| | | |

|

|

All

|

DataFormat optional encryptedDataFormatType Simple Type

EncryptionDataFormat is an optional field to be used for encryption Version "05" to define the encryption encoding format

EncryptionDataFormat 1 Denotes the CardData sent to PORTICO is Binary

EncryptionDataFormat 2 Denotes the CardData sent to PORTICO is ASCII

|

|

Version encryptionVersionType Simple Type

The encryption version used on the supplied data.

For PAN encryption, use version "02" or "04" for Heartland E3 encryption. This requires the client to parse the E3 MSR output. The encrypted PAN is passed in the card data element as the manual entry card number. The KTB must be provided as part of the encryption data. If sending an encrypted CVV2, use version "04" which expects the PAN and CVV2 to be encrypted.

For PAN encryption, use version "05" for TDES DUKPT encryption with and without CVV encryption. This requires the client to parse the output. The encrypted PAN is passed in the card data element as the manual entry card number. The KSN must be provided as part of the encryption data.

For track encryption, use version "01", "02", or "04" for Heartland E3 encryption. Version "01" will not require parsing and it will not require additional fields in the encryption data, but the full E3 MSR output must be passed in the card data element as track data. Version "02" and "04" requires the client to parse the E3 MSR output. The KTB must be provided as part of the encryption data. In addition, the client must parse the data specific to either encrypted track 1 or track 2 and provide this in the card data element as track data as well as supply the track number as EncryptedTrackNumber.

For track encryption, use either version "03" for AES encryption with DUKPT, or "05" for TDES encryption with DUKPT. The "03" option supports the IdTECH card readers. The "05" option will work with any device that supports TDES with DUKPT data encryption per AINSI 9.24-1. Both options require the client to parse reader output. The KSN must be provided as part of the encryption data. In addition, the client must parse the data specific to either encrypted track 1 or track 2 and provide this in the card data element as track data as well as supply the track number as EncryptedTrackNumber.

For track encryption "05" is used for TDES encryption with DUKPT. The "05" option will work with any device that supports TDES with DUKPT data encryption per ANSI 9.24-1. Both options require the client to parse reader output. The KSN must be provided as part of the encryption data. In addition, the client must parse the data specific to either encrypted track 1 or track 2 and provide this in the card data element as track data, as well as supply the track number as EncryptedTrackNumber.

|

|

|

| |

|

TokenRequest optional booleanType Simple Type

This is used to request the gateway to return a multi-use token for the supplied card data. If a token is provided in the card data and this flag is set, it will be echoed in the response.

|

|

|

All

|

Mapping optional TokenMappingType Simple Type

This indicates the type of token to return; see the associated Type enumerations for specific values supported.

Note: If not supplied, "CONSTANT" is assumed. This means that the same token will be returned for the same card data.

| | | | |

|

Amt amtTypeGlobal Simple Type

The amount requested for authorization; this includes all other "Info" amounts provided as part of this request.

|

|

AmountIndicator optional amountIndicatorType Simple Type

Valid values include:

- 'E' indicates that Amt is an estimated amount

- 'F' indicates the Amt is final

Note: In the case of 'F', the Amt should not be manipulated and no CreditIncrementalAuth should be ran.

|

|

PaymentMethodKey optional guidType Simple Type

Unique key generated by PayPlan associated with a stored payment method

Note: When using a key, card data should not be sent. However, stored customer data can be overridden using the card holder data.

|

|

PaymentMethodKeyData optional PaymentMethodKeyData Complex Type

These fields provide a way to override stored payment information or to provide additional information in card present situations. This is for the current transaction only and will not be stored for future use.

Note: This element is only valid when supplying a PaymentMethodKey.

|

All

|

ExpMonth optional monthType Simple Type

Expiration month

Note: If expiration month and year are provided, they will be used for processing the transaction rather than the stored values associated with the provided token. This is for the current transaction only and will not be stored for future use.

|

|

ExpYear optional Restriction of yearType Simple Type

Expiration year

Note: If expiration month and year are provided, they will be used for processing the transaction rather than the stored values associated with the provided token. This is for the current transaction only and will not be stored for future use.

|

|

CVV2 optional Restriction of cvv2Type Simple Type

CVV Number ("Card Verification Value"); 3 digits on VISA, MasterCard, Discover and UnionPay and 4 on American Express.

CVV numbers are also known as CSC numbers ("Card Security Code"), as well as CVV2 numbers, which are the same as CVV numbers, except that they have been generated by a 2nd generation process.

Note: This field is not used for EBT transactions.

|

|

CVV2Status optional cvv2Status Simple Type

Indicates why the CVV2 value was not provided; see the associated Type enumerations for specific values supported.

Note: This field is not used for EBT transactions.

| | |

|

|

All

|

CardHolderZip optional zipType Simple Type

Zip or postal code; see the associated Type pattern for restrictions.

Note: Canadian postal codes should be sent in the format "A0A0A0".

|

| |

|

AllowDup optional booleanType Simple Type

This is important in cases where the client processes a large number of similar transactions in a very short period of time; sending "Y" will skip duplicate checking on this transaction.

|

|

|

All

|

InvoiceNbr optional Restriction of xs:string

Used to log the invoice number on transactions that are not eCommerce.

|

| |

|

|

All

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Note: This is returned in the response and should never be used in the request.

| | |

|

DebtRepaymentIndicator optional debtRepaymentType Simple Type

Allows for flagging the transaction as being against a debt obligation and applies to Visa and Discover transactions only. The card associations have strict requirements for usage. This flag must not be used without explicit direction from Global Payments.

|

|

CPCReq optional booleanType Simple Type

This is used to request the issuer to return whether or not the supplied card is a commercial card

Note: See the CPCInd in the corresponding response transaction detail.

|

|

|

All

|

TaxType optional taxTypeType Simple Type

Tax type indicator that qualifies the associated tax amount, see the associated Type enumerations for specific values supported.

|

|

TaxAmt optional amtTypeGlobal Simple Type

Tax amount

Note: If the tax type is 'TaxExempt', an amount should not be provided. If it is, the gateway discards the amount.

|

|

|

All

|

BuyerRecipientName optional Restriction of xs:string

Required on transactions with an amount over 150.

|

| | | |

|

|

All

|

CategoryInd optional CategoryIndType Simple Type

Mastercard CIT/MIT indicator subcategory

Valid values include:

- 01 - Unscheduled Credential-on-file

- 02 - Standing Order (variable amount and fixed frequency)

- 03 - Subscription (fixed amount and frequency)

- 06 - Related/Delayed Charge

- 07 - No Show Charge

- 08 - Resubmission

Note: Future use for GSAP-AP merchants

| | |

|

SecureECommerce optional SecureECommerceType Complex Type

Allows for sending Secure ECommerce data associated with the transaction. This data must be obtained from a certified device that conform to the 3DSecure standard.

NOTE: This functionality is deprecated. All new integrations are expected to use the Secure3D and, where applicable, WalletData blocks. All existing integrations to SecureECommerce need to be updated to use the new data block(s).

|

All

|

PaymentData optional Extension of PaymentDataType Simple Type

Payment Data received from payment tokenization service. Supported formats are Visa CAVV, Discover CAVV, AMEX Token Data Blocks, and MaterCard UCAF. All considered to be 3DSecure Type of Payment Data. Binary data must be encoded using base16 (Hex encoding) or base64 encoding.

Note:For Brand based 3DSecure Payment Data Sources, Payment Data is optional if no Payment Data was received due to a failed attempt to authenticate the card holder, in example.

For ApplePay, ApplePayApp, ApplePayWeb, GooglePayApp, GooglePayWeb, Payment Data is required.

|

|

ECommerceIndicator optional ECommerceIndicatorType Simple Type

Optional Electronic Commerce Indicator or MasterCard UCI returned from the payment tokenization service to indicate the authentication results of the credit card payment.

Note:The ECommerceIndicator is ignored when PaymentDataSource is ApplePay, ApplePayApp, ApplePayWeb, GooglePayApp, GooglePayWeb.

|

|

XID optional Extension of XIDType Simple Type

XID genrated at the client which identifies the 3-D Secure transaction.

| | |

|

|

All

|

Cryptogram optional Extension of cryptogramType Simple Type

Cryptogram received from wallet payment. Supported formats are DSRP, TokenBlocks and TAVV cryptograms. Must be encoded using base16 (Hex encoding) or base64 encoding.

|

|

ECI optional eciType Simple Type

Electronic Commerce Indicator associated with the Cryptogram. This is an optional field.

|

|

DigitalPaymentToken optional xs:string

Payment payload used to send encrypted apple or google pay data.

|

| |

|

|

All

|

SubMerchantId Restriction of xs:long

The ID assigned by the payment facilitator or aggregator to the sub-merchant.

Note: For internal use only.

|

|

Addr1 Restriction of xs:string

The street address of the sub-merchant.

Note: For internal use only.

|

|

City Restriction of xs:string

The city of the sub-merchant.

Note: For internal use only.

|

|

StateProvinceRegion optional Restriction of xs:string

The state or province of the sub-merchant.

Note: For internal use only.

|

|

ZipPostalCode Restriction of xs:string

The ZIP/Postal Code of the sub-merchant.

Note: For internal use only.

|

|

CountryCode Restriction of xs:int

The 3-digit ISO Numeric Country Code of the sub-merchant (eg, 840)

Note: For internal use only.

|

|

CustomerSvcPhone Restriction of xs:string

Sub-merchant phone number.

Note: For internal use only.

|

|

CustomerSvcEmail optional Restriction of xs:string

Sub-merchant email address.

Note: For internal use only.

|

|

TerminalId Restriction of xs:string

The sub-merchant Terminal ID assigned by the payment facilitator.

Note: For internal use only.

|

|

MCC Restriction of xs:string

Sub-merchant MCC.

Note: For internal use only.

| | |

|

TxnDescriptor optional TxnDescriptorType Simple Type

Transaction description that is concatenated to a configurable merchant DBA name. The resulting string is sent to the card issuer as the Merchant Name.

Note: Updates to the device are required to utilize this feature. See your Heartland representative for more details.

|

|

EUSingleTap optional booleanType Simple Type

This field provides a way for a European merchant to indicate whether a transaction is a Single Tap contactless transaction, or whether the request contains an intentionally duplicated (replayed) ATC value. Applies to MC transactions only. Valid values: Y - SingleTap N - ReplayedATC

|

|

|

All

|

SCAExemptionType SCAExemptionTypeType Simple Type

Eligible exemption to Strong Customer authentication (SCA) for the transaction.

Valid values include:

- 'TrustedMerchant' Trusted merchant exemption claimed/requested.

- 'LowValue' Transaction exemption from SCA as the merchant has determined it to be a low value payment.

- 'SecureCorporatePayment' Transaction exemption from SCA as the merchant has determined it as a SCP.

- 'TxnRiskAnalysis' TRA exemption claimed/requested.

- 'DelegatedAuth' Issuer has delegated SCA.

- 'AuthenticationOutage' Authentication outage

- 'MerchantInitiated' Merchant initiated

- 'RecurringPayment' Recurring payment

Note: Visa Merchant ID is required when the SCA Exemption Type is Trusted Merchant or Delegated Authentication.

|

|

SCAVisaMerchantId optional Restriction of xs:string

Note: Visa Merchant ID for Trusted Merchant and Delegated Authentication exemptions, required when the SCA Exemption Type is Trusted Merchant or Delegated Authentication

| | | |