|

All

|

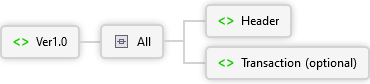

Header

Contains tracking information, echoed fields, and gateway response indicators.

The specific fields returned can vary. Clients should code to be able to potentially receive any optional elements at any time. New elements being added should not break client code.

Note: This should be inspected by the client to determine if the gateway was able to complete the processing of the associated request.

Note: If gateway successfully processed the request, the client will still need to check the transaction response details, if any, to determine the final result based on any issuer decisions.

|

All

|

GatewayRspCode gatewayRspCodeType Simple Type

Gateway response code that indicates what occurred on the gateway while processing the request.

Note: This does not indicate approval or decline. Clients must see if additional information is provided in the transaction portion of the message from the issuer or other system.

|

|

GatewayRspMsg optional gatewayRspMsgType Simple Type

Gateway response message that may provide additional information to the client or user.

Note: In some cases the information may not assist the client or user directly, but it can be provided to a support representative to assist in problem resolution.

|

|

RspDT optional xs:dateTime

Transaction response date and time in the time zone stored for the associated site.

|

|

|

All

|

TokenRspCode optional xs:int

Response code specific to the tokenization process; the processing of the request will not be impacted by tokenization failures in most cases.

|

|

TokenRspMsg optional xs:string

Response message specific to the tokenization process that may provide additional information to the client or user

Note: In some cases the information may not assist the client or user directly, but it can be provided to a support representative to assist in problem resolution.

|

|

TokenValue optional xs:string

The generated (or echoed) multi-use token; this can be used by the client on subsequent calls in the card data element.

| | |

|

|

All

|

OriginalRspDT xs:dateTime

Contains the original transaction response date and time in the time zone stored for the associated site.

|

|

OriginalCardNbrLast4 xs:string

Contains the original last four digits of the account number used on the original transaction.

|

| |

|

|

|

BatchId optional batchIdType Simple Type

If the transaction was added to a batch, this is the associated batch id.

Note: This field is only returned if the device is configured for this option during the boarding process.

|

|

BatchSeqNbr optional xs:int

If the transaction was added to a batch, this is the batch's sequence number.

Note: This field is only returned if the device is configured for this option during the boarding process.

|

|

CustomHash optional xs:string

Fingerprint value for customer-specific usage.

|

|

MerchCurrencyCode optional xs:string

Indicates the 3-digit currency code of the merchant.

|

|

MerchCurrencyText optional xs:string

Indicates the 3-digit currency acronym of the merchant

|

|

RetryInd optional booleanType Simple Type

Indicates that this transaction is a retry of the previous, in case if a timeout error occurred. GTID and Source fields are required for RetryInd.

The time alloted for retries is 90 minutes.

Note: It is internal only

|

| |

|

Transaction optional

Transaction result details, issuer results codes and messages, authorization codes, balances, etc.

The specific fields returned can vary. Clients should code to be able to potentially receive any optional elements at any time. New elements being added should not break client code.

Note: Clients will need to inspect information returned in this portion to determine the final result of the requested transaction (i.e., approvals and declines).

|

Choice

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

| | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

| | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

| | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Session optional

Session Information from processor

|

|

Processor optional

Additional processor response information

| | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

| | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

| | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

| | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

| | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Shipping optional

Shipping Information for the Session

|

|

Payment optional

Payment Information for the Session

|

|

LineItem optional

Line Item purchase information for the session

|

|

Processor optional

Additional processor response information

| | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

| | |

|

|

Sequence

|

CredentialToken xs:string

A credential token that can be used to identify a specific user session on subsequent requests

| | |

|

|

All

|

BatchId xs:int

The gateway-generated batch id of the closed batch

|

|

TxnCnt xs:int

The number of transactions closed (sent for settlement)

|

|

HostTotalCnt optional xs:int

Total number of transactions in the host batch.

|

|

HostTotalAmt optional xs:decimal

Sum of transaction amounts in the host batch.

|

| |

|

|

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response (result) text returned by the check processor; additional error messages may be separated by a hyphen (-)

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the check processor

|

| |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response (result) text returned by the check processor; additional error messages may be separated by a hyphen (-)

|

| |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response (result) text returned by the check processor; additional error messages may be separated by a hyphen (-)

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the check processor

|

| |

|

|

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

|

PaymentFacilitatorTxnId optional xs:string