|

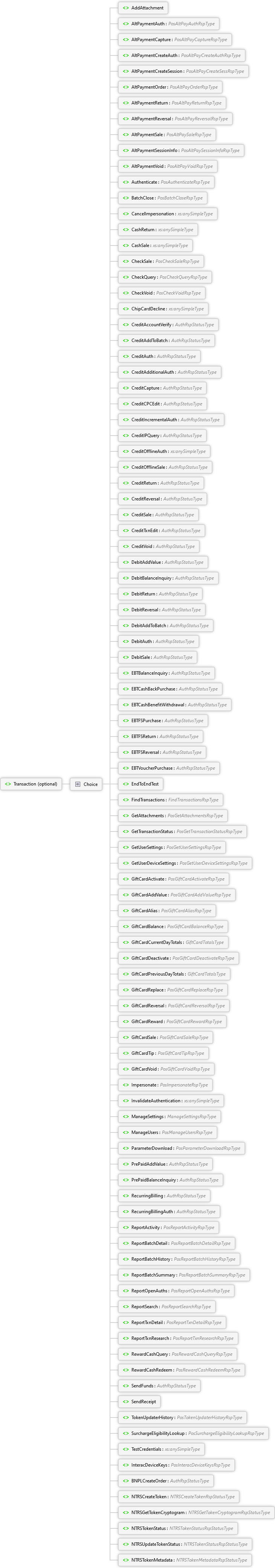

Transaction optional

Transaction result details, issuer results codes and messages, authorization codes, balances, etc.

The specific fields returned can vary. Clients should code to be able to potentially receive any optional elements at any time. New elements being added should not break client code.

Note: Clients will need to inspect information returned in this portion to determine the final result of the requested transaction (i.e., approvals and declines).

|

Choice

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

|

Sequence 1..100

| | | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

|

Sequence 1..100

| | | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

|

Sequence 1..100

| | | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Session optional

Session Information from processor

|

Sequence 0..∞

| |

|

Processor optional

Additional processor response information

|

Sequence 1..100

| | | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

|

Sequence 1..100

| | | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

|

Sequence 1..100

| | | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

|

Sequence 1..100

| | | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

|

Sequence 1..100

| | | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

|

Sequence 0..∞

| |

|

Shipping optional

Shipping Information for the Session

|

Sequence 1..10

| |

|

Payment optional

Payment Information for the Session

|

Sequence 1..200

| |

|

LineItem optional

Line Item purchase information for the session

|

Sequence 1..100

| |

|

Processor optional

Additional processor response information

|

Sequence 1..100

| | | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response message returned by the processor

|

|

Status optional xs:string

Status from processors processing of the transaction

|

|

StatusMessage optional xs:string

Status message from processors processing of the transaction

|

|

Processor optional

Additional processor response information

|

Sequence 1..100

| | | |

|

|

Sequence

|

CredentialToken xs:string

A credential token that can be used to identify a specific user session on subsequent requests

| | |

|

|

All

|

BatchId xs:int

The gateway-generated batch id of the closed batch

|

|

TxnCnt xs:int

The number of transactions closed (sent for settlement)

|

|

HostTotalCnt optional xs:int

Total number of transactions in the host batch.

|

|

HostTotalAmt optional xs:decimal

Sum of transaction amounts in the host batch.

|

| |

|

|

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response (result) text returned by the check processor; additional error messages may be separated by a hyphen (-)

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the check processor

|

|

|

All

|

InvoiceNbr optional Restriction of xs:string

Used to log the invoice number on transactions that are not eCommerce.

|

| |

|

|

Sequence

|

Type optional xs:string

Indicates type of response information:

- Error

- Decline

- Information

- Warning

- Approve

- Unknown

|

|

Code optional xs:string

Check processor response code(s); overall single response code or detail response codes separated by a hyphen (-)

|

|

Message optional xs:string

Message description of the provided code

|

|

FieldNumber optional xs:string

Field number that is in error

|

|

FieldName optional xs:string

Field name that is in error

| | | | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response (result) text returned by the check processor; additional error messages may be separated by a hyphen (-)

|

|

|

Sequence

|

Type optional xs:string

Indicates type of response information:

- Error

- Decline

- Information

- Warning

- Approve

- Unknown

|

|

Code optional xs:string

Check processor response code(s); overall single response code or detail response codes separated by a hyphen (-)

|

|

Message optional xs:string

Message description of the provided code

|

|

FieldNumber optional xs:string

Field number that is in error

|

|

FieldName optional xs:string

Field name that is in error

| | | | |

|

|

Sequence

|

RspCode xs:int

Response (result) code indicating the overall success of the transaction; '0' indicates success while non-zero indicates a failure.

|

|

RspMessage optional xs:string

Response (result) text returned by the check processor; additional error messages may be separated by a hyphen (-)

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the check processor

|

|

|

All

|

InvoiceNbr optional Restriction of xs:string

Used to log the invoice number on transactions that are not eCommerce.

|

| |

|

|

Sequence

|

Type optional xs:string

Indicates type of response information:

- Error

- Decline

- Information

- Warning

- Approve

- Unknown

|

|

Code optional xs:string

Check processor response code(s); overall single response code or detail response codes separated by a hyphen (-)

|

|

Message optional xs:string

Message description of the provided code

|

|

FieldNumber optional xs:string

Field number that is in error

|

|

FieldName optional xs:string

Field name that is in error

| | | | |

|

|

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

|

All

|

TransactionCode optional xs:string

Code that indicates type of transaction on the host.

|

|

FieldKey optional xs:string

Used to decrypt field information.

|

|

TraceNumber optional xs:string

Number identifying original transaction.

|

|

MessageAuthenticationCode optional xs:string

A block of encrypted data to be sent from the POS on every contact Interac sale and return request. Required for Canadian merchants processing debit reversals.

| | |

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

|

All

| |

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

All

|

VISEligiblePlans optional

This block provides information regarding eligible Visa Installment Service (VIS) installment plans, to be presented to the cardholder (EligiblePlans).

When the CardNbr and Amt are eligible, VIS returns 2 to n installment plans. Multiple plans are returned in the response.

When the CardNbr and Amt are not eligible, VIS returns a success response but EligiblePlans will be empty.

| | |

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

|

All

|

CurrConvOptOutFlag booleanType Simple Type

This setting indicates if the Customer has decided Opt Out of currency conversion and have the amount remain in the Merchants currency. If the customer does not opt out, the amount will be converted to currency associated with the card.

|

|

RateLookupTxnId optional guidType Simple Type

The Retrieval Reference Number (RRN) of the RateLookup or Incremental Authorization that provided the rate used for the calculations in this transaction, if it is different from the original Authorization.

|

|

MarkupFee optional Restriction of xs:decimal

The mark up percentage applied to the transaction, resulting in the commission fee.

| | |

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

|

All

|

TransactionCode optional xs:string

Code that indicates type of transaction on the host.

|

|

FieldKey optional xs:string

Used to decrypt field information.

|

|

TraceNumber optional xs:string

Number identifying original transaction.

|

|

MessageAuthenticationCode optional xs:string

A block of encrypted data to be sent from the POS on every contact Interac sale and return request. Required for Canadian merchants processing debit reversals.

| | |

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

|

All

| |

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

All

|

VISEligiblePlans optional

This block provides information regarding eligible Visa Installment Service (VIS) installment plans, to be presented to the cardholder (EligiblePlans).

When the CardNbr and Amt are eligible, VIS returns 2 to n installment plans. Multiple plans are returned in the response.

When the CardNbr and Amt are not eligible, VIS returns a success response but EligiblePlans will be empty.

| | |

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

|

All

|

CurrConvOptOutFlag booleanType Simple Type

This setting indicates if the Customer has decided Opt Out of currency conversion and have the amount remain in the Merchants currency. If the customer does not opt out, the amount will be converted to currency associated with the card.

|

|

RateLookupTxnId optional guidType Simple Type

The Retrieval Reference Number (RRN) of the RateLookup or Incremental Authorization that provided the rate used for the calculations in this transaction, if it is different from the original Authorization.

|

|

MarkupFee optional Restriction of xs:decimal

The mark up percentage applied to the transaction, resulting in the commission fee.

| | |

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

|

All

|

TransactionCode optional xs:string

Code that indicates type of transaction on the host.

|

|

FieldKey optional xs:string

Used to decrypt field information.

|

|

TraceNumber optional xs:string

Number identifying original transaction.

|

|

MessageAuthenticationCode optional xs:string

A block of encrypted data to be sent from the POS on every contact Interac sale and return request. Required for Canadian merchants processing debit reversals.

| | |

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

|

All

| |

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

All

|

VISEligiblePlans optional

This block provides information regarding eligible Visa Installment Service (VIS) installment plans, to be presented to the cardholder (EligiblePlans).

When the CardNbr and Amt are eligible, VIS returns 2 to n installment plans. Multiple plans are returned in the response.

When the CardNbr and Amt are not eligible, VIS returns a success response but EligiblePlans will be empty.

| | |

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

|

All

|

CurrConvOptOutFlag booleanType Simple Type

This setting indicates if the Customer has decided Opt Out of currency conversion and have the amount remain in the Merchants currency. If the customer does not opt out, the amount will be converted to currency associated with the card.

|

|

RateLookupTxnId optional guidType Simple Type

The Retrieval Reference Number (RRN) of the RateLookup or Incremental Authorization that provided the rate used for the calculations in this transaction, if it is different from the original Authorization.

|

|

MarkupFee optional Restriction of xs:decimal

The mark up percentage applied to the transaction, resulting in the commission fee.

| | |

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

|

All

|

TransactionCode optional xs:string

Code that indicates type of transaction on the host.

|

|

FieldKey optional xs:string

Used to decrypt field information.

|

|

TraceNumber optional xs:string

Number identifying original transaction.

|

|

MessageAuthenticationCode optional xs:string

A block of encrypted data to be sent from the POS on every contact Interac sale and return request. Required for Canadian merchants processing debit reversals.

| | |

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

|

All

| |

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

All

|

VISEligiblePlans optional

This block provides information regarding eligible Visa Installment Service (VIS) installment plans, to be presented to the cardholder (EligiblePlans).

When the CardNbr and Amt are eligible, VIS returns 2 to n installment plans. Multiple plans are returned in the response.

When the CardNbr and Amt are not eligible, VIS returns a success response but EligiblePlans will be empty.

| | |

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

|

All

|

CurrConvOptOutFlag booleanType Simple Type

This setting indicates if the Customer has decided Opt Out of currency conversion and have the amount remain in the Merchants currency. If the customer does not opt out, the amount will be converted to currency associated with the card.

|

|

RateLookupTxnId optional guidType Simple Type

The Retrieval Reference Number (RRN) of the RateLookup or Incremental Authorization that provided the rate used for the calculations in this transaction, if it is different from the original Authorization.

|

|

MarkupFee optional Restriction of xs:decimal

The mark up percentage applied to the transaction, resulting in the commission fee.

| | |

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

|

All

|

TransactionCode optional xs:string

Code that indicates type of transaction on the host.

|

|

FieldKey optional xs:string

Used to decrypt field information.

|

|

TraceNumber optional xs:string

Number identifying original transaction.

|

|

MessageAuthenticationCode optional xs:string

A block of encrypted data to be sent from the POS on every contact Interac sale and return request. Required for Canadian merchants processing debit reversals.

| | |

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

|

All

| |

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

All

|

VISEligiblePlans optional

This block provides information regarding eligible Visa Installment Service (VIS) installment plans, to be presented to the cardholder (EligiblePlans).

When the CardNbr and Amt are eligible, VIS returns 2 to n installment plans. Multiple plans are returned in the response.

When the CardNbr and Amt are not eligible, VIS returns a success response but EligiblePlans will be empty.

| | |

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

|

All

|

CurrConvOptOutFlag booleanType Simple Type

This setting indicates if the Customer has decided Opt Out of currency conversion and have the amount remain in the Merchants currency. If the customer does not opt out, the amount will be converted to currency associated with the card.

|

|

RateLookupTxnId optional guidType Simple Type

The Retrieval Reference Number (RRN) of the RateLookup or Incremental Authorization that provided the rate used for the calculations in this transaction, if it is different from the original Authorization.

|

|

MarkupFee optional Restriction of xs:decimal

The mark up percentage applied to the transaction, resulting in the commission fee.

| | |

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

|

All

|

TransactionCode optional xs:string

Code that indicates type of transaction on the host.

|

|

FieldKey optional xs:string

Used to decrypt field information.

|

|

TraceNumber optional xs:string

Number identifying original transaction.

|

|

MessageAuthenticationCode optional xs:string

A block of encrypted data to be sent from the POS on every contact Interac sale and return request. Required for Canadian merchants processing debit reversals.

| | |

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

|

All

| |

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

All

|

VISEligiblePlans optional

This block provides information regarding eligible Visa Installment Service (VIS) installment plans, to be presented to the cardholder (EligiblePlans).

When the CardNbr and Amt are eligible, VIS returns 2 to n installment plans. Multiple plans are returned in the response.

When the CardNbr and Amt are not eligible, VIS returns a success response but EligiblePlans will be empty.

| | |

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

|

All

|

CurrConvOptOutFlag booleanType Simple Type

This setting indicates if the Customer has decided Opt Out of currency conversion and have the amount remain in the Merchants currency. If the customer does not opt out, the amount will be converted to currency associated with the card.

|

|

RateLookupTxnId optional guidType Simple Type

The Retrieval Reference Number (RRN) of the RateLookup or Incremental Authorization that provided the rate used for the calculations in this transaction, if it is different from the original Authorization.

|

|

MarkupFee optional Restriction of xs:decimal

The mark up percentage applied to the transaction, resulting in the commission fee.

| | |

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

|

All

|

TransactionCode optional xs:string

Code that indicates type of transaction on the host.

|

|

FieldKey optional xs:string

Used to decrypt field information.

|

|

TraceNumber optional xs:string

Number identifying original transaction.

|

|

MessageAuthenticationCode optional xs:string

A block of encrypted data to be sent from the POS on every contact Interac sale and return request. Required for Canadian merchants processing debit reversals.

| | |

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

|

All

| |

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

All

|

VISEligiblePlans optional

This block provides information regarding eligible Visa Installment Service (VIS) installment plans, to be presented to the cardholder (EligiblePlans).

When the CardNbr and Amt are eligible, VIS returns 2 to n installment plans. Multiple plans are returned in the response.

When the CardNbr and Amt are not eligible, VIS returns a success response but EligiblePlans will be empty.

| | |

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

|

All

|

CurrConvOptOutFlag booleanType Simple Type

This setting indicates if the Customer has decided Opt Out of currency conversion and have the amount remain in the Merchants currency. If the customer does not opt out, the amount will be converted to currency associated with the card.

|

|

RateLookupTxnId optional guidType Simple Type

The Retrieval Reference Number (RRN) of the RateLookup or Incremental Authorization that provided the rate used for the calculations in this transaction, if it is different from the original Authorization.

|

|

MarkupFee optional Restriction of xs:decimal

The mark up percentage applied to the transaction, resulting in the commission fee.

| | |

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)

- "42" (Sanctions Scoring Service: Score exceeds Applicable Threshold Values)

- "43" (Virtual card number can be used multiple times)

|

|

CAVVResultCode optional xs:string

The Visa Cardholder Authentication Verfication Value results code. This is returned by Visa when using SecureECommerce.

|

|

TokenPANLast4 optional xs:string

Last 4 digits of PAN associated with Token. This may be returned by issuer when using SecureECommerce.

|

|

|

All

|

TransactionCode optional xs:string

Code that indicates type of transaction on the host.

|

|

FieldKey optional xs:string

Used to decrypt field information.

|

|

TraceNumber optional xs:string

Number identifying original transaction.

|

|

MessageAuthenticationCode optional xs:string

A block of encrypted data to be sent from the POS on every contact Interac sale and return request. Required for Canadian merchants processing debit reversals.

| | |

|

HostRspDT optional xs:dateTime

Processing Host response date and time.

Note:For Canadian merchants, the HostRspDT contains the timestamp to be printed on the customer receipt.

|

|

CardBrandTxnId optional xs:string

This is the Network Transaction Identifier returned by the Card Brand.

|

|

|

All

| |

|

IpTerms optional IPTermsRspDataType Complex Type

Information on the Installment Plan chosen by the customer. Usage varies by region and the Installments service provider:

Merchants located in the Asia Pacific region must provide the NbrInstallments and Program. SIPOptions is optional.

Merchants located in Mexico must provide the NbrInstallemnts, InstallmentPlan, and GracePeriod only.

Merchants located in Canada using Visa Installment Service (VIS) must provide the Program and VISOptions.

|

All

|

VISEligiblePlans optional

This block provides information regarding eligible Visa Installment Service (VIS) installment plans, to be presented to the cardholder (EligiblePlans).

When the CardNbr and Amt are eligible, VIS returns 2 to n installment plans. Multiple plans are returned in the response.

When the CardNbr and Amt are not eligible, VIS returns a success response but EligiblePlans will be empty.

| | |

|

PaymentFacilitatorTxnId optional xs:string

Unique transaction identifier assigned by the payment facilitator. This identifier is for use only by the payment facilitator, and should not be used as a reference in future client requests to the Portico Gateway.

|

|

PaymentFacilitatorTxnNbr optional xs:string

Unique account identifier assigned by the payment facilitator for the sub-merchant. This is used as the sub-merchant account reference if contacting the payment facilitator for support.

|

|

|

All

|

CurrConvOptOutFlag booleanType Simple Type

This setting indicates if the Customer has decided Opt Out of currency conversion and have the amount remain in the Merchants currency. If the customer does not opt out, the amount will be converted to currency associated with the card.

|

|

RateLookupTxnId optional guidType Simple Type

The Retrieval Reference Number (RRN) of the RateLookup or Incremental Authorization that provided the rate used for the calculations in this transaction, if it is different from the original Authorization.

|

|

MarkupFee optional Restriction of xs:decimal

The mark up percentage applied to the transaction, resulting in the commission fee.

| | |

|

AccountReference optional xs:string

Returned by the issuer in the authorization response when available. It is alphanumeric and may be up to 35 characters, the length of the value may vary by card brand.

Note: Account Reference is supported only for the Exchange and GNAP-UK authorization platforms.

|

|

BnplId optional xs:string

Id received from the BNPL Provider

|

|

RedirectUrl optional xs:string

Redirect url for the provider

|

|

AgreementId optional xs:string

Value returned by Visa in authorization responses for merchants participating in the Commercial Choice Program.

|

|

ExtendedAuthRsp optional Restriction of xs:string

When ExtendedAuthInd is included in the request, this element returns the result.

Valid values include:

'Y' - indicates the issuer approved the extension; funds will be held for up to 30 days

'N' - indicates the issuer did not approve the extension; funds will be held for the standard period

|

|

TxnLinkId optional xs:string

Transaction Link Identifier (TLID).This is a 22 character value generated by Mastercard.

| | |

|

|

|

|

All

|

RspCode xs:string

Response (result) code returned by the issuer

|

|

RspText optional xs:string

Response (result) text returned by the issuer

|

|

AuthCode optional xs:string

If authorized, authorization code returned by the issuer

|

|

AVSRsltCode optional xs:string

If address verification requested, address verification result code returned by the issuer

|

|

CVVRsltCode optional xs:string

If card verification was provided on the request, card verification result code returned by the issuer

|

|

CPCInd optional xs:string

If commercial card was specified in the request, commercial card response indicator returned by the issuer.

Valid values include:

- B (Business Card)

- R (Corporate Card)

- S (Purchasing Card)

- L (B2B - Settlement amount may not exceed Authorized amount)

- E (B2B - Settlement amount must equal Authorized amount)

Note: If this is returned with one of these values, the client should obtain additional information from the card holder and provide it to the gateway via a CreditCPCEdit before this transaction is closed.

|

|

RefNbr optional xs:string

Reference number returned by the processor or issuer

|

|

AuthAmt optional amtTypeGlobal Simple Type

Actual amount authorized; could differ from requested for partial authorizations

Note: If not returned, the authorized amount is the requested amount.

|

|

CardType optional xs:string

The card type processed based on configured BIN ranges

|

|

AVSRsltText optional xs:string

Address verification result description returned by the issuer

|

|

CVVRsltText optional xs:string

Card verification result description returned by the issuer

|

|

TxnDescriptor optional xs:string

The dynamic portion of this was provided in the header of the request; this is the final string sent to the issuer based on the provided value and the values configured during boarding

|

|

RecurringDataCode optional xs:string

MasterCard value that may be returned on recurring transactions.

Valid values include:

- "01" (New account information available)

- "02" (Cannot approve at this time, try again later)

- "03" (Do not try again)

- "04" (Declined due to lack of cryptography or partial shipment indicator)

- "21" (Recurring Payment Cancellation Service)

- "22" (Request another form of payment)

- "24" (Retry after 1 hour)

- "25" (Retry after 24 hour)

- "26" (Retry after 2 days)

- "27" (Retry after 4 days)

- "28" (Retry after 6 days)

- "29" (Retry after 8 days)

- "30" (Retry after 10 days)

- "40" (Non-reloadable prepaid, do not use for recurring)

- "41" (Single-use virtual, do not use for recurring)